Centre for Innovation in Regulatory Science (CIRS)

ack in 1969, the World Health Organization (WHO) Certificate of Pharmaceutical Product (CPP) was implemented to accelerate the availability of new drugs in developing countries by providing evidence of the quality of products. Nonetheless, there are still differences in the usage of CPPs by regulatory agencies in Growth and Emerging Markets (GEMs) that may lead to challenges relating to today’s more innovative, complex, globalized products.

This article presents an updated overview of previous research developed by the Centre for Innovation in Regulatory Science (CIRS) on how CPPs have been used for the marketing authorization of New Active Substances (NASs) in 18 GEM countries between 2021 and 2022 with a special focus on three aspects: CPP submission timing, CPP legalization, and adoption of eCPP format, considering both guidelines-based agency requirements and current company practices.

Results

The analysis results of companies’ current practices are based on an extract from the CIRS Growth & Emerging Markets Metrics (GEMM) database. This extract includes experience provided by 14 global pharmaceutical companies that obtained NAS marketing authorizations in 18 GEMs (ARG: Argentina, BRA: Brazil, COL: Colombia, MEX: Mexico, DZA: Algeria, EGY: Egypt, ISR: Israel, RUS: Russia, SAU: Saudi Arabia, ZAF: South Africa, TUR: Turkey, CHN: China, IND: India, IDN: Indonesia, MYS: Malaysia, SGP: Singapore, KOR: South Korea, and TWN: Chinese Taipei) between 2021 and 2022. Additionally, the analysis results of guidelines-based agency requirements are based on an extract of the Clarivate Analytics Cortellis for Regulatory Intelligence® (CRI) database.

CPP Submission Timing: How do guidelines-based agency requirements compare to recent company practices, and what is their impact on the median rollout time?

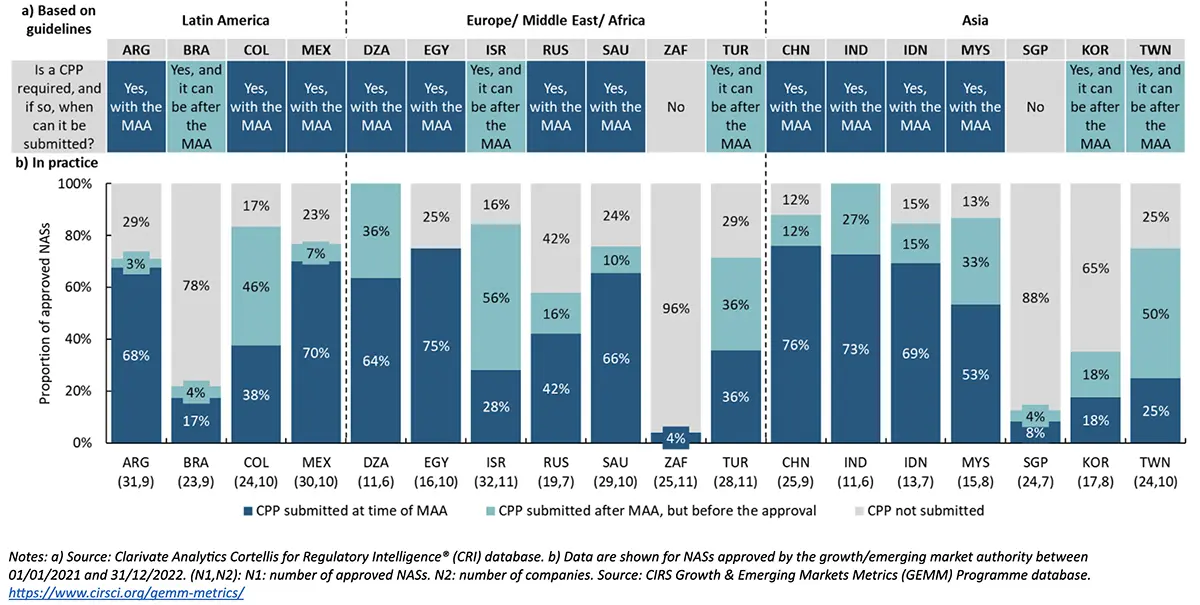

Key messages of Figure 1:

Focusing on the guidelines-based agency requirements, 61% (11 of 18) of GEM countries required CPPs at the time of the marketing authorization application (MAA) submission, followed by 28% (5 of 18) of GEM countries that require a CPP prior to approval following MAA submission. In contrast, South Africa and Singapore did not require a CPP for marketing authorization purposes.

On the other hand, based on company practice:

- China had the highest percentage of approved NASs where a CPP was submitted at the time of MAA (76%). Egypt followed this with 75%, India with 73%, Mexico with 70%, and Indonesia with 69%.

- Submitting CPPs after the MAA (but before the approval) was most common in Israel, with 56% of the approved NASs, followed by Chinese Taipei with 50%, Colombia with 46%, and Algeria and Turkey with 36% each.

- Compared to previous study results in 2016-2017, CPP submission timing appeared to be more flexible in 2021-2022 among GEM countries such as Colombia, Algeria, Russia, Indonesia, China, and Mexico, where companies were able to submit CPPs after the MAA (but before the approval) despite their guideline-based requirements which require CPP with submission. This could relate to a company strategy change or greater agency flexibility.

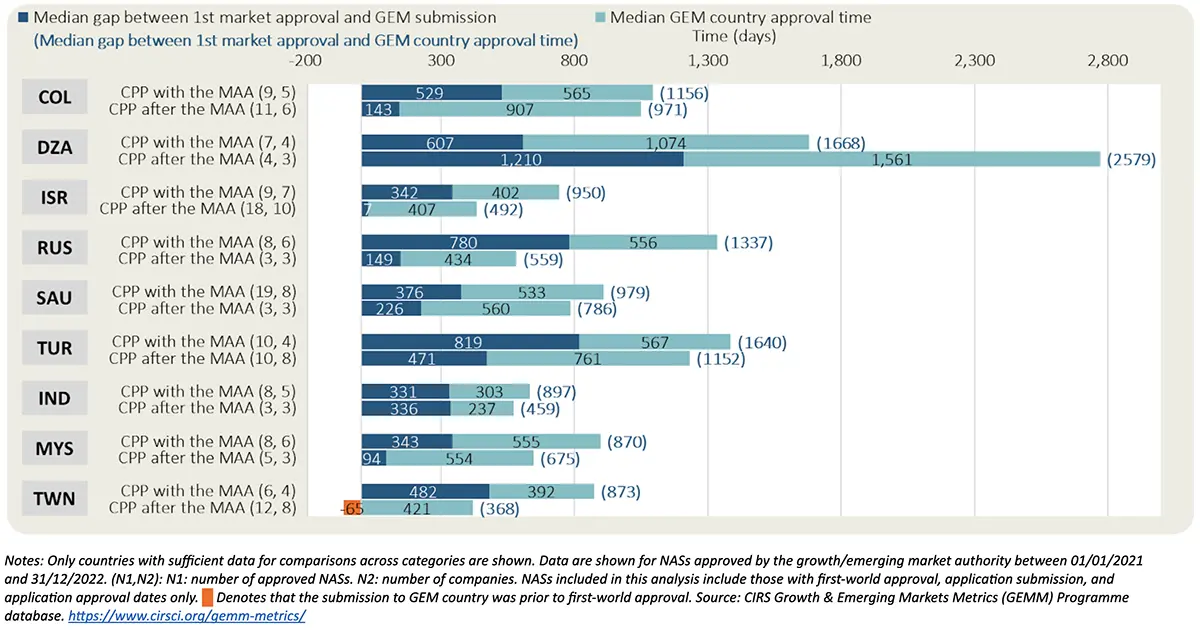

Based on companies’ practices, seven out of nine GEM countries where companies submitted CPPs after the MAA (but before the approval) had shorter median submission gap (i.e., median time between the first market approval date and GEM country submission date) and shorter median rollout time (i.e., median time between first market approval date and GEM country approval date) compared to when companies submitted the CPP at the time of the MAA.

CPP Legalization: What are the Practices Among GEMs?

CPP legalization, along with other document authentication processes such as an apostille or notarization, is a formal procedure used to verify the authenticity of a CPP, ensuring it is recognized as legitimate in the importing country. The embassy or consulate of the country issuing the CPP can conduct this legalization process.

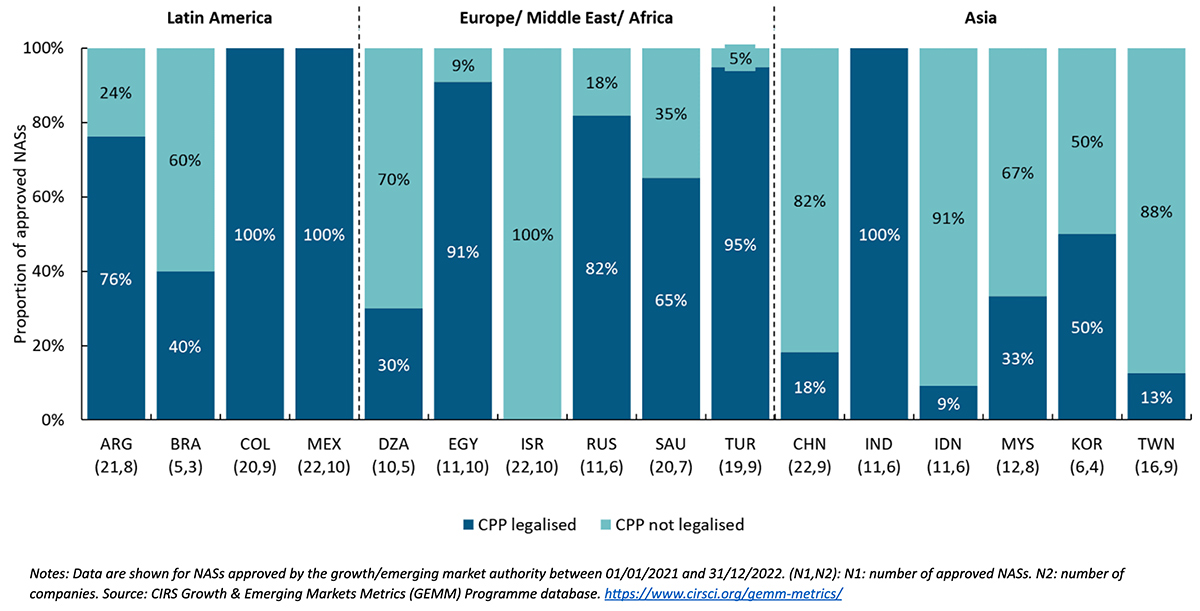

Key messages of Figure 3:

- Focusing on company practices, the country where the highest proportion of submitted CPPs were not legalized was Israel, followed by Indonesia with 91%, Chinese Taipei with 88%, China with 82%, and Algeria with 70% of approved NASs.

- In contrast, the countries where the highest proportion of submitted CPPs were legalized were Colombia, India, and Mexico, followed by Turkey, which had 95%, and Egypt, which had 91% of approved NASs.

- Companies’ submission practices suggest that fewer legalized CPPs were submitted in Chinese Taipei, Brazil, Saudi Arabia, Argentina, and Algeria between 2021 and 2022 compared to previous study results in 2016-2017.

Agencies have expressed concerns about the potential for counterfeit CPPs without legalization. Nonetheless, the 55th report of the WHO Expert Committee on Specifications for Pharmaceutical Preparations states that the latest draft of the WHO Certification Scheme on the Quality of Pharmaceutical Products Moving in International Commerce includes revisions to discourage legalization procedures that unduly delay certificates.

A more straightforward solution to guarantee CPP authenticity can be achieved by adopting electronic formats like eCPPs, which have easy verification systems that can be found directly from the agency’s website (e.g., EMA’s eCPPs). Another alternative to prove CPP authenticity may be the use of publicly available approval documentation such as public assessment reports (PARs), which can be downloaded directly from the issuing agency’s website, such as the ones developed by FDA, EMA, Health Canada, PMDA, Swissmedic, and TGA, among others.

Final recommendations made at the 2018 WHO ICDRA meeting stated, “WHO should advocate for the use of an electronic CPP template by issuing and receiving authorities to expedite the process and mitigate against any further need for legalisation.”

eCPP Format Adoption: What are the practices and what is their impact on the median rollout time?

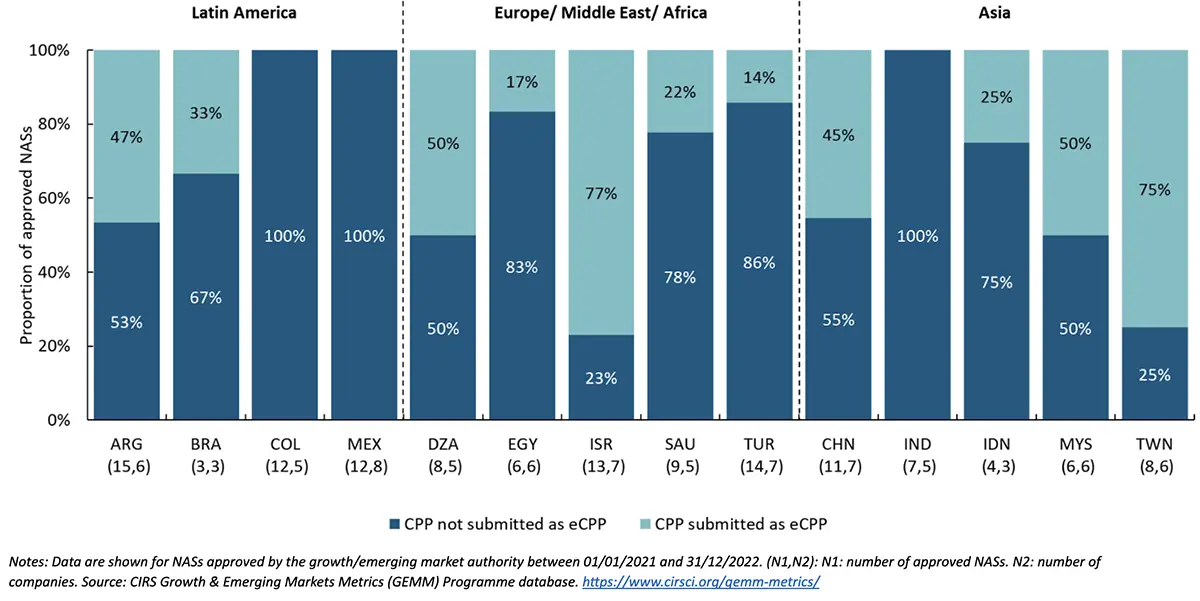

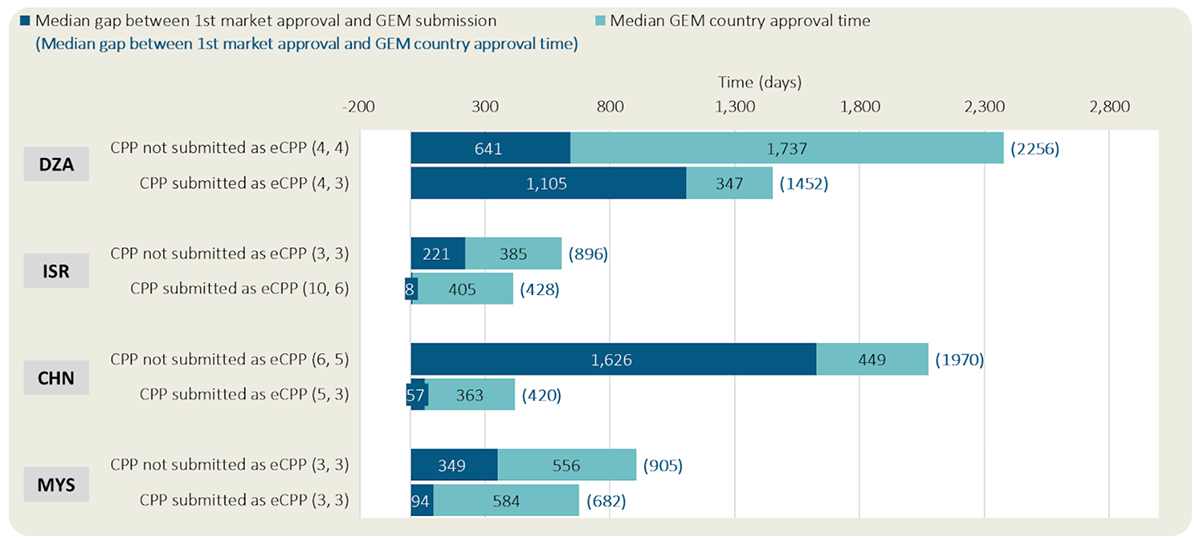

Key messages of Figure 4:

- Based on companies’ practices, Israel had the highest proportion of CPPs submitted as eCPPs with 77% of approved NASs, followed by Chinese Taipei, which had 75%, Algeria and Malaysia with 50% each, and Argentina with 47% of the approved NASs.

- Conversely, Egypt had only 17% of CPPs submitted as eCPP, followed by Turkey with 14%, while none of the CPPs submitted in Colombia, Mexico, or India were eCPPs.

- Based on companies’ practices, three out of four GEM countries where eCPPs were submitted had shorter median submission gap and median rollout time than when eCPPs were not submitted.

Notes: Only countries with sufficient data for comparisons across categories are shown. Data are shown for NASs approved by the growth/emerging market authority between 01/01/2021 and 31/12/2022. (N1,N2): N1: number of approved NASs. N2: number of companies. NASs included in this analysis include those with first-world approval, application submission, and application approval dates only. Denotes that the submission to GEM country was prior to first-world approval. Source: CIRS Growth & Emerging Markets Metrics (GEMM) Programme database. https://www.cirsci.org/gemm-metrics/

Conclusion

Most Growth and Emerging Markets (GEM) countries require the submission of a Certificate of Pharmaceutical Product (CPP) at the marketing authorization application (MAA) submission. However, recent company practices suggest an increased flexibility in CPP submission among GEM countries compared to previous findings. Notably, submitting the CPP after the MAA (but before the approval) appears to be associated with shorter submission gaps and faster rollout times in many GEM regions.

Company experience also suggests regional differences in the submission of legalized CPPs since most Asian GEM countries received a lower proportion of legalized CPPs than other GEM countries.

On the other hand, submitting a CPP as an eCPP appears to be emerging as a common practice, particularly in most Asian GEM countries. This may be because eCPP utilization can reduce the time required to issue and legalize CPPs, facilitating an earlier submission and leading to faster rollout globally.

In conclusion, regulatory flexibility—whether in the timing of CPP submission, authentication of CPP, or adoption of electronic formats—plays a crucial role in streamlining the regulatory process and ensuring quicker access to innovative therapies for populations in these markets.