Around The Globe

New Development of Rare Disease Policy in China

Kuo Jiao

Weicheng Wu

Fosun Pharma USA, Inc.

ince the passage of the Orphan Drug Act by the US Congress in 1983, many other countries have followed suit in later years to develop their own orphan drug legislation or regulation. In China, although there have been some sporadic guidelines and opinions on the subject from various agencies since 2007, an official definition of a rare disease or a clear regulatory pathway for rare disease products was not available until recently.

Disclaimer: The thoughts and opinions expressed in this article belong solely to the authors and do not reflect the views of the authors’ employer or any other organization, group, or individual the authors are affiliated with. The article includes unofficial policy explanations and projections that may not be correct. Any action you take upon the information provided in this article is strictly at your own risk.

In 2016, the Expert Committee of Rare Disease Treatment and Support was formed under the National Health Commission (NHC, then NHFPC) and consists of medical experts in different fields as well as experts in health insurance and health policy. From the beginning, the Chinese government saw the lack of rare disease regulatory pathways not merely as a medical problem but also as an economic issue for the national health insurance.

In 2017, the China National Drug Administration (CNDA) proposed a ten-year exclusivity for “new rare disease drugs” (comparable to the US 505b (1) New Drug Application) and a three-year exclusivity for “improved new rare disease drugs.” If implemented, these measures are significant for drug development as they provide specifics for review and marketing incentives.

New Policy Change

New Rare Disease List

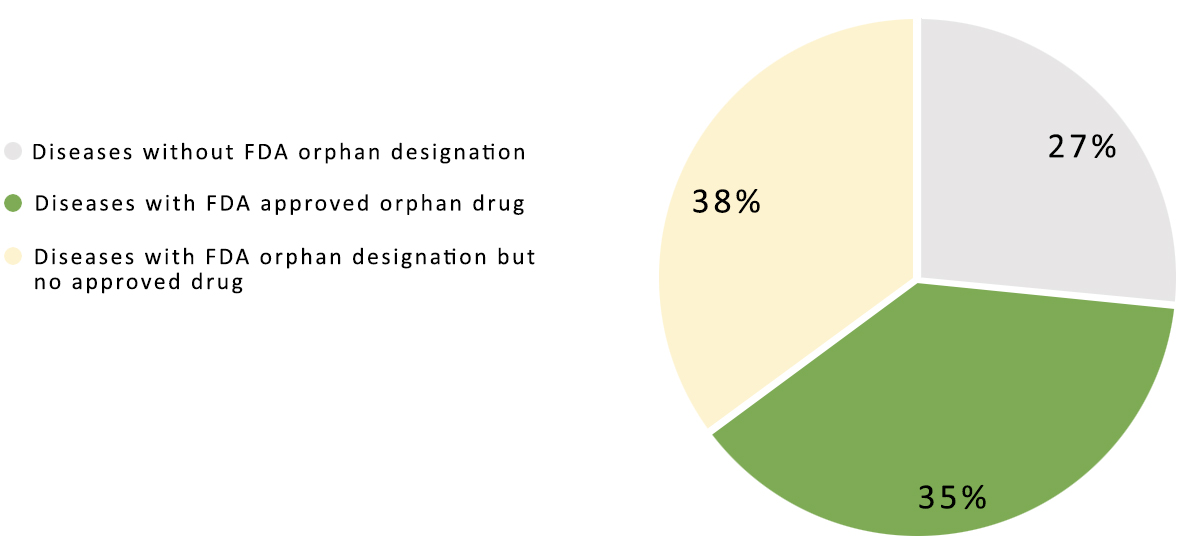

On May 22, 2018, the new NHC, along with the CNDA and three other agencies jointly published the first edition of the Rare Disease List. The list includes 121 diseases covering various genetic disorders; however, many types of cancers that have orphan status in the US are not included in the list. In contrast, the US Food and Drug Administration (FDA) currently has over 4,500 approved orphan designations, yet some diseases on the CNDA list are not in the FDA database (Figure 1). The list shows that China is not only interested in bringing in existing treatments, but is also preparing to lead orphan drug development in certain areas in the future.

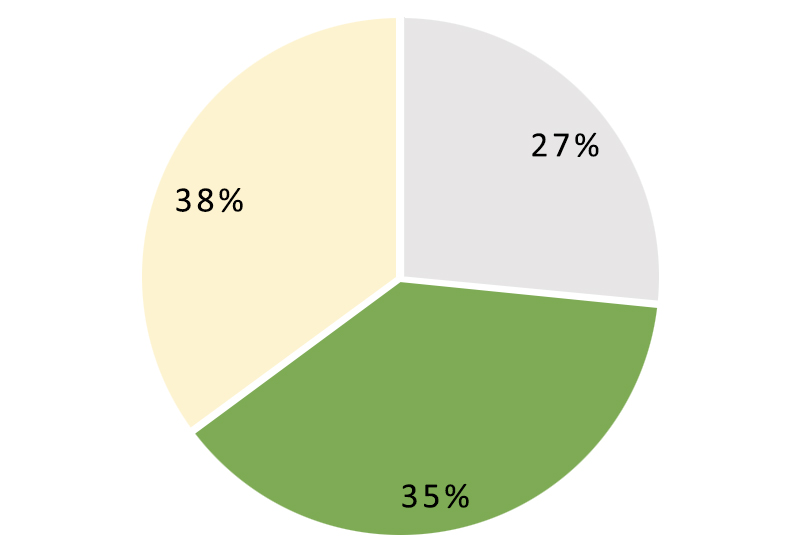

Figure 1. Current US FDA orphan drug status.

Figure 1. Current US FDA orphan drug status.

Petition and Revision of the Rare Disease List

On May 28, 2018, a much less recognized but very substantial document, the Procedure of Developing the Rare Disease List protocol, was released, explaining the mechanism for rare disease selection and outlining a future pathway for adding more diseases to the list. According to the protocol, the jurisdiction to adjust the Rare Disease List falls in the hands of NHC. The protocol lists the following four criteria for rare disease designation:

- The disease has a low prevalence or incidence in China and other countries.

- The disease significantly impacts the patient and his or her family.

- There is a clear method of diagnosis.

- The disease is treatable and intervention is feasible and economically accessible. Alternatively, there is no currently available treatment but the disease is being investigated under a government-funded research program.

It’s important to note that a quantitative criterion for “low prevalence or incidence” is still lacking. And the last criteria could potentially impose some economic restrictions on the potential development of a rare disease drug.

An important caveat in this document is that it limits who can file a petition for adding a new disease to the list. It states that national and provincial government agencies, national professional societies, or other non-governmental organizations (NGOs) recognized by the Chinese government may petition to amend the list. However, companies and individuals are not explicitly permitted to do so.

Additionally, the list “will usually be updated no more frequently than every two years.” This means that new indications will be batch-added every two years or more. This approach differs from the US and EU where orphan designations are granted on an individual basis. It is therefore advised that sponsors should begin discussing and collaborating with NGOs or professional societies early to ensure that the indication is added to the list by the time it is updated.

Important Development on Acceptance of Overseas Clinical Data

On June 20, 2018, the State Council issued an opinion that orphan drugs and drugs for unmet medical needs can be approved with overseas clinical data only if certain conditions are met, and that the CNDA shall review the application within 3 and 6 months, respectively. This not only adds a clear review timeline to the regulatory pathway, but it also promises to accelerate approvals significantly.

Based on a draft released in October 2017, the CNDA issued final guidance on July 10, 2018 regarding the acceptance of overseas clinical data for China registration. In this document, the CNDA clarifies modules that need to be submitted and outlines several scenarios of data acceptance. The main takeaway is that a rare disease drug can gain approval with overseas clinical data, regardless of whether the drug has been approved in other countries or not. Even if there are potential ethnic differences with regard to safety and efficacy, an orphan drug can still gain conditional approval with post-approval commitments to assess efficacy and safety in the Chinese patient population (Table 1).

Table 1. Overview of foreign clinical data acceptance standards and special considerations for rare disease indications.

Level of Acceptance

Acceptable

Scenario

- Reliable foreign clinical trial data, compliant with ICH GCP and site inspection requirements.

- Trial results support efficacy and safety endpoints; no racial differences.

With Rare Disease Indication

Approval

Level of Acceptance

Partially Acceptable

Scenario

- Reliable foreign clinical trial data, compliant with ICH GCP and site inspection requirements.

- Trial results support efficacy and safety endpoints; but racial differences exist and results do not apply to Chinese population.

- Sponsor should consult with CNDA and conduct further evaluations for additional trials.

With Rare Disease Indication

Conditional Approval with post-approval commitment to track efficacy and safety

Level of Acceptance

Not Acceptable

Scenario

- Questionable foreign data reliability, integrity, certainty, or traceability.

- Poor efficacy or safety results.

- Sponsor should follow IND and NDA and conduct systematic clinical trials in China to support application.

With Rare Disease Indication

Not Acceptable

Implications

Caveats and Potentials of the Rare Disease List

Although CNDA is bridging the gap between historical issues and international practice at an unprecedented pace, this new move has a few distinct features. Currently, in the US the FDA grants orphan designation to a sponsor’s application based solely on the disease’s prevalence. The European Medicines Agency (EMA) takes a similar approach. In China, however, the list is not created by CNDA, but by the national health authority. The inclusion criteria also contain economic and policy considerations. And unlike the US and many other countries, China’s rare disease program is not application-based, where sponsors apply for a specific designation for their drugs. Rather, it is disease-based, so all products indicated to treat the disease will be covered by the new policy.

In the Procedure of Developing the Rare Disease List protocol, the revision criteria include economic accessibility. What’s more, the application material must include proposed treatment pricing and approaches as well as current insurance coverage and social assistance status for the disease in other major countries. Based on the composition of the Expert Committee of Rare Disease Treatment and Support, and the details stated in the review criteria, it is made clear any treatment for rare diseases highlighted by the Chinese government should be urgently needed and economically acceptable.

That said, there is no need for sponsors to be too concerned about market prospects. On the bright side, the new policy may imply that the government is seeking to include the listed diseases in National Health Insurance coverage. In other words, drugs for the listed indications could benefit by becoming more broadly accessible with smaller price tags. Currently, some major cities in China, such as Shanghai and Qingdao, are offering multilayer coverage systems that pool state and private payers to significantly reduce the cost for patients.

Opportunity for Overseas Clinical Data

The acceptance of overseas clinical data also has a significant impact on drug development and access. Traditionally, companies were required to submit clinical trial applications and conduct clinical trials in China before filing for approval. The lengthy process made registration of some orphan products in China unfeasible in terms of cost and time, which in turn caused many orphan drugs to remain inaccessible to Chinese patients. With the new acceptance of overseas clinical data, companies can now get orphan drugs approved in China based solely on overseas clinical trial data – a prospect that is very attractive. Companies that provide orphan products in other countries should reevaluate their products for registration in China. For those products approved in ICH regions, the companies may directly translate the clinical dossiers for Chinese submissions with minimum modifications. Emphasis should be specifically on life-threatening and high-burden pediatric diseases that get the most support and attention from the government and patients. Furthermore, the acceptance of overseas clinical data means it is potentially possible to file applications for new orphan products simultaneously in China and other regions, even if the clinical trials are conducted overseas, which is a big win for Chinese patients.

What’s Next?

With development incentives, a list of indications, and a clear pathway for foreign clinical data usage, the rare disease program in China seems to be off to a good start. We will likely see accelerated approvals of multiple orphan products based on foreign clinical data. The orphan drug market in China will likely expand greatly, and patients will benefit from broader access to drugs. We are optimistic that the current trend will allow more opportunities for local and international players alike.

Note that the China National Drug Administration (CNDA) was recently renamed to National Medical Products Administration, or NMPA.

Supplemental resources available upon request.

Kuo Jiao is a current regulatory affairs intern at Fosun Pharma USA, Inc. He is pursuing a Master of Public Health degree at Yale University and is interested in regulatory policy in the US and China. Kuo can be reached at kuo.jiao@yale.edu.

Weicheng Wu is the Vice President for Regulatory Affairs at Fosun Pharma USA, Inc. Weicheng can be reached at wuweicheng@fosunpharma.com.