PharmCube

riven by drugmakers’ growing interest in accessing the world’s second-largest pharmaceutical market, China has recently seen a steady increase in the approval of new drugs—defined as those granted marketing authorization for the first time in the country. In 2024, these newly approved drugs spanned a diverse range of technologies, indications, and origins.

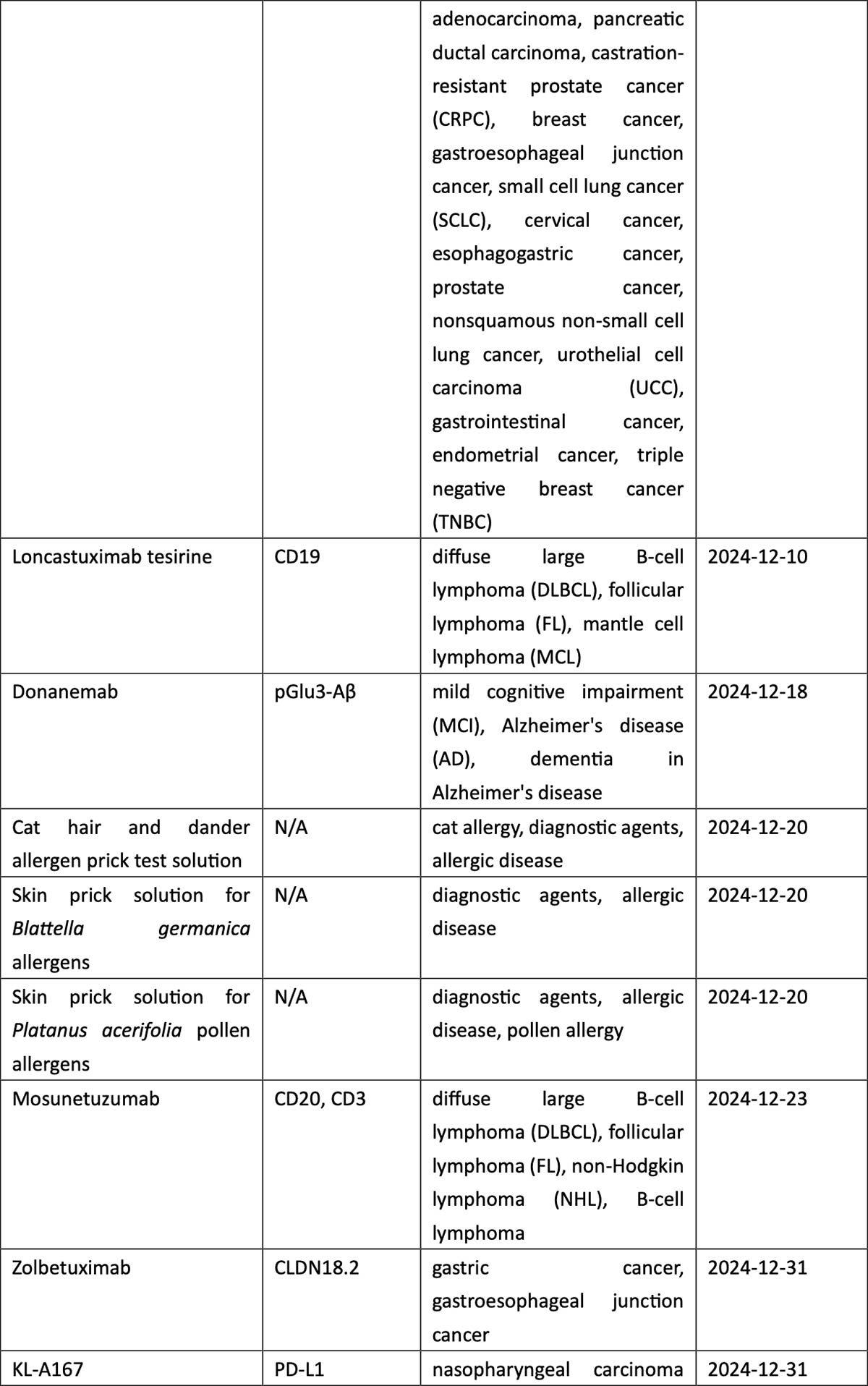

During 2024, local regulator the National Medical Products Administration (NMPA) green-lit 83 new drugs (excluding Traditional Chinese Medicines), up 12% from 2023 and significantly more than the 50 novel medicines approved in the US in this same timeframe.

Longstanding Technologies Enjoy Greater Popularity

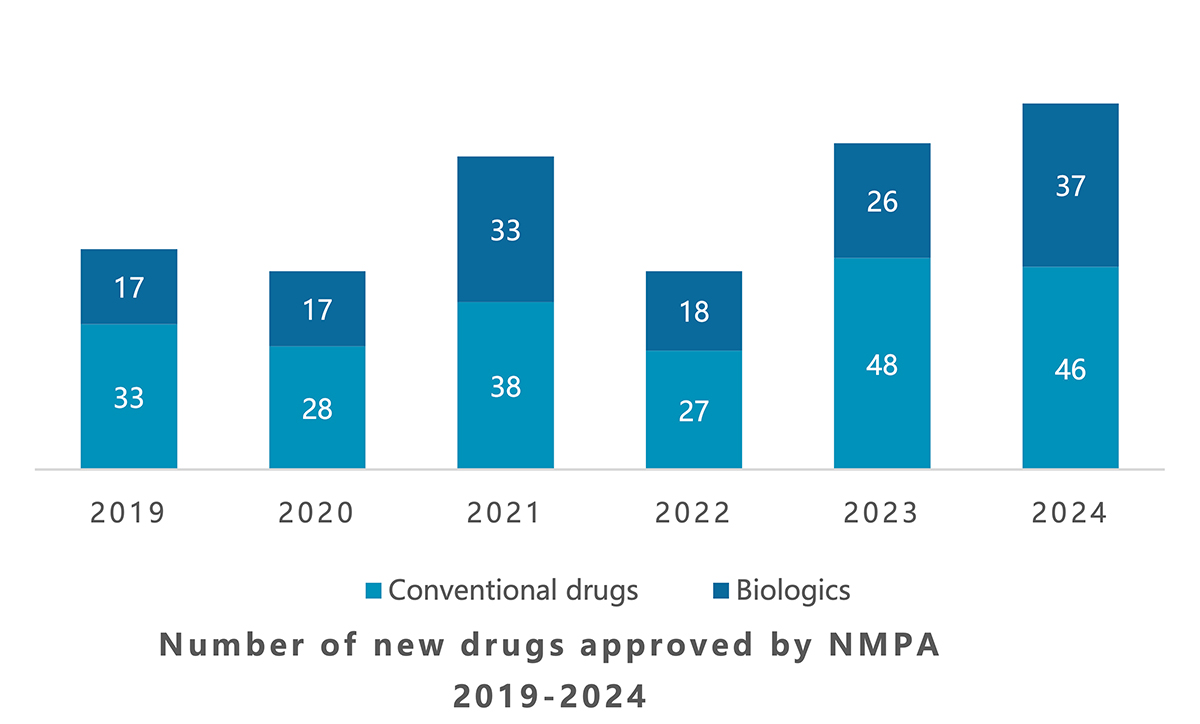

The distribution of new arrivals by drug type mostly follows the timeline of technological developments in the industry. Thanks to their long presence in the global market, small-molecule drugs accounted for the lion’s share of new drug approvals in China with 51% of the total, followed by the well-established segment of mAbs with 20% (see following graphic). Relatively new ADCs, BsAbs, cell therapies, and nucleic acid-based therapies trailed behind, as did peptides and blood products, due to their niche medical applications.

ADC = antibody-drug conjugate; BsAb = bispecific antibody; mAb = monospecific antibody.

The Name of the Game: Profitability

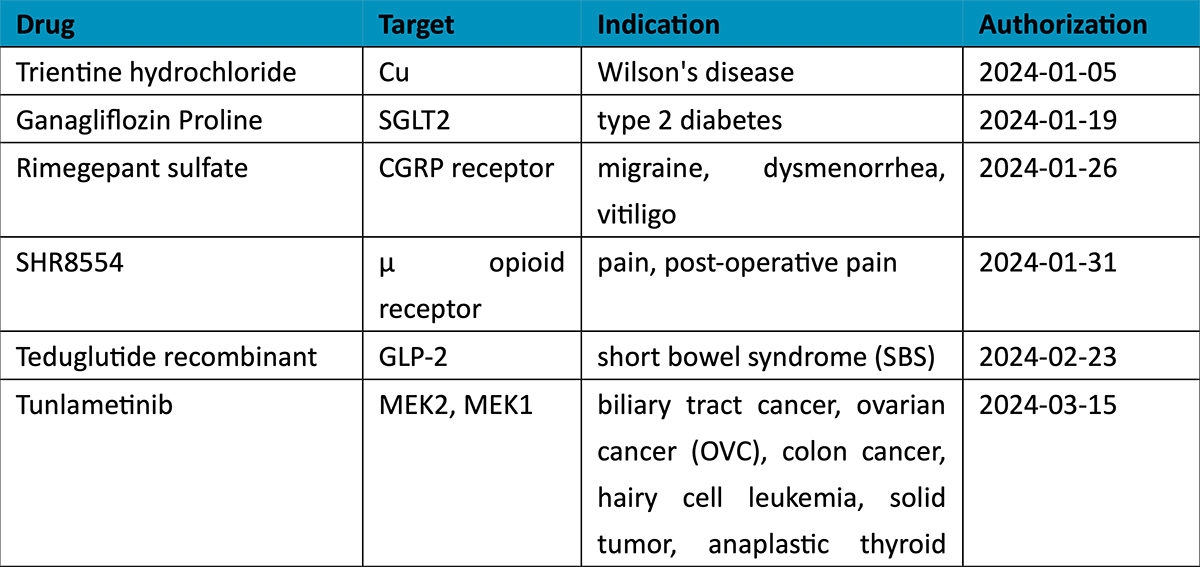

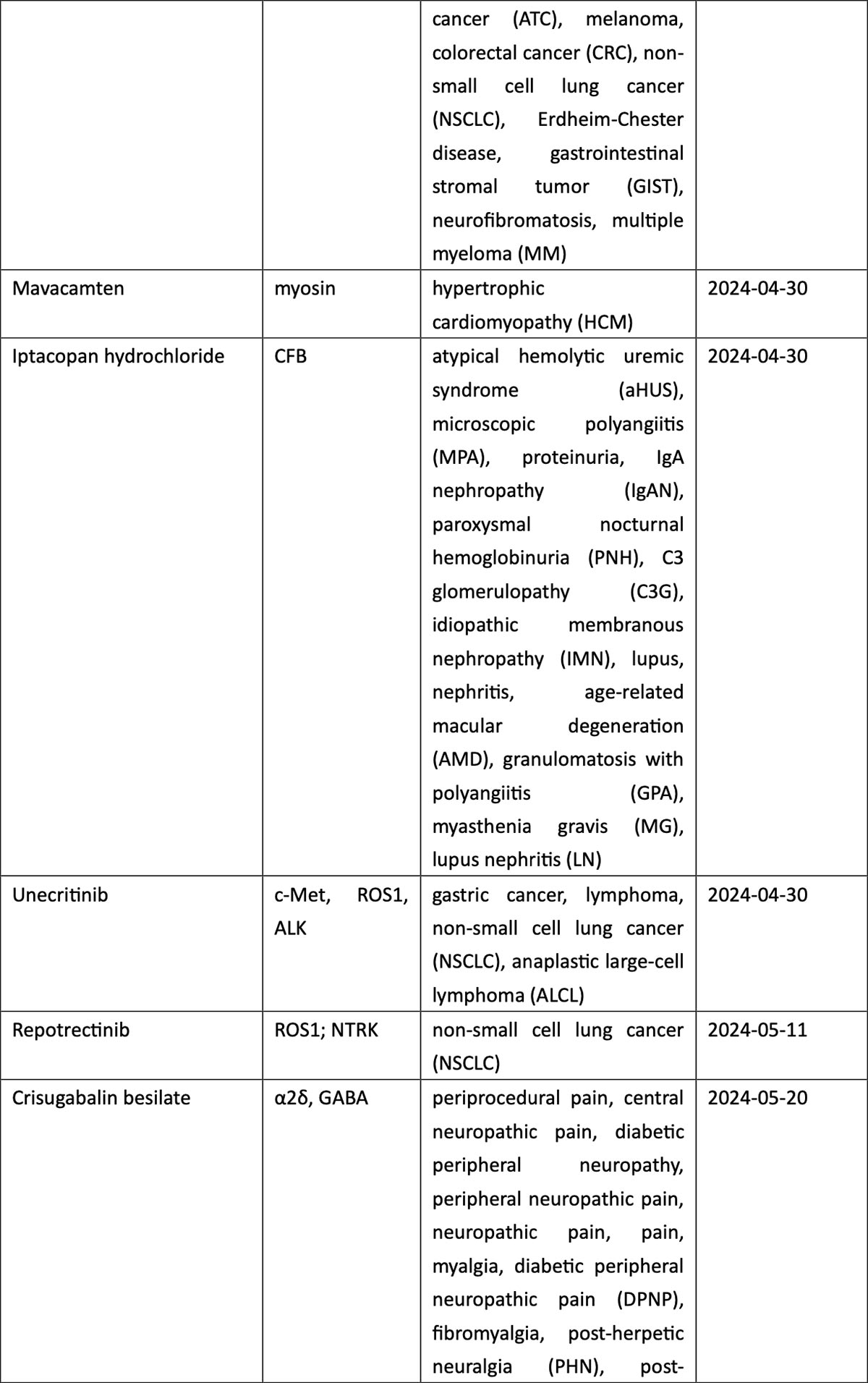

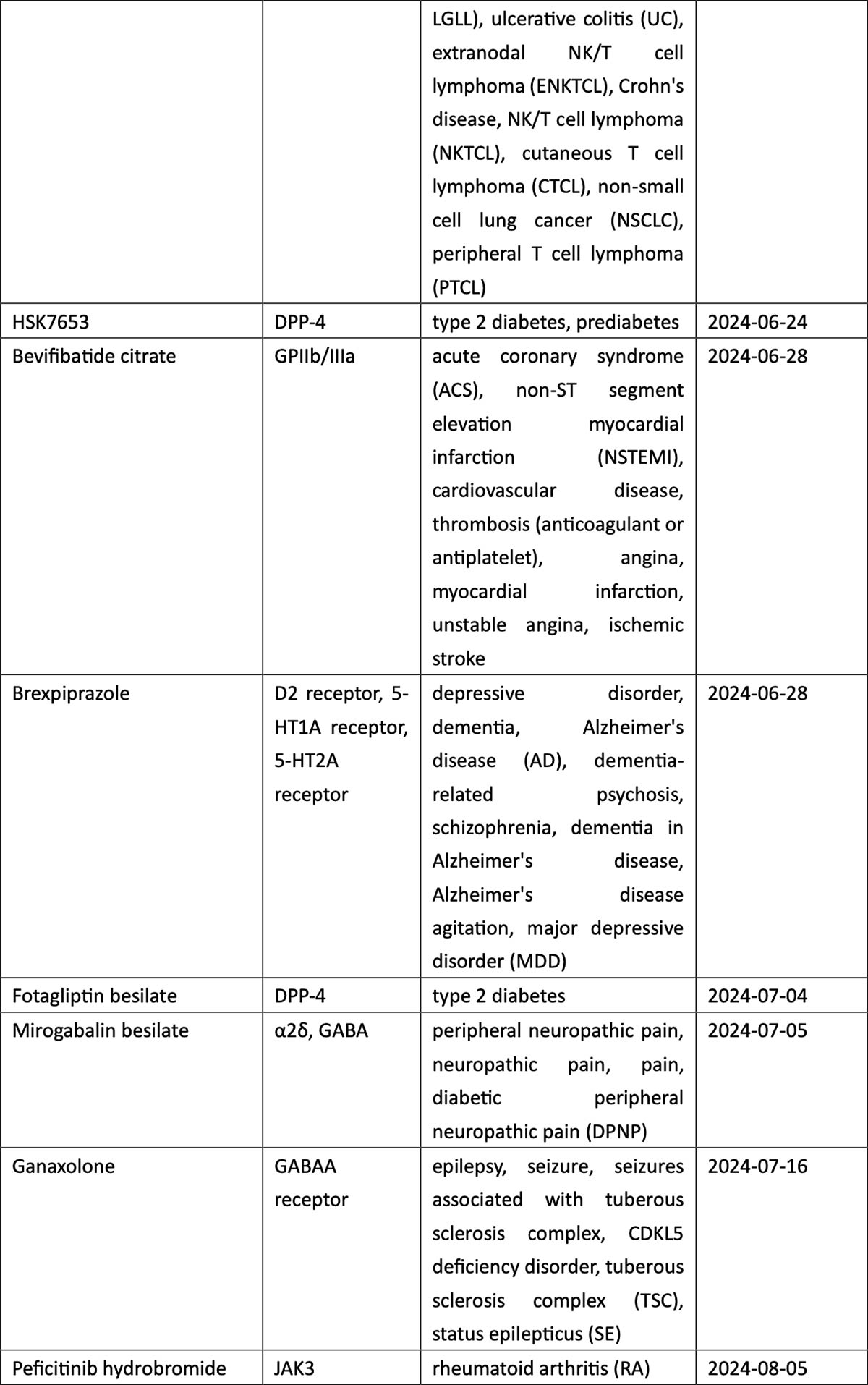

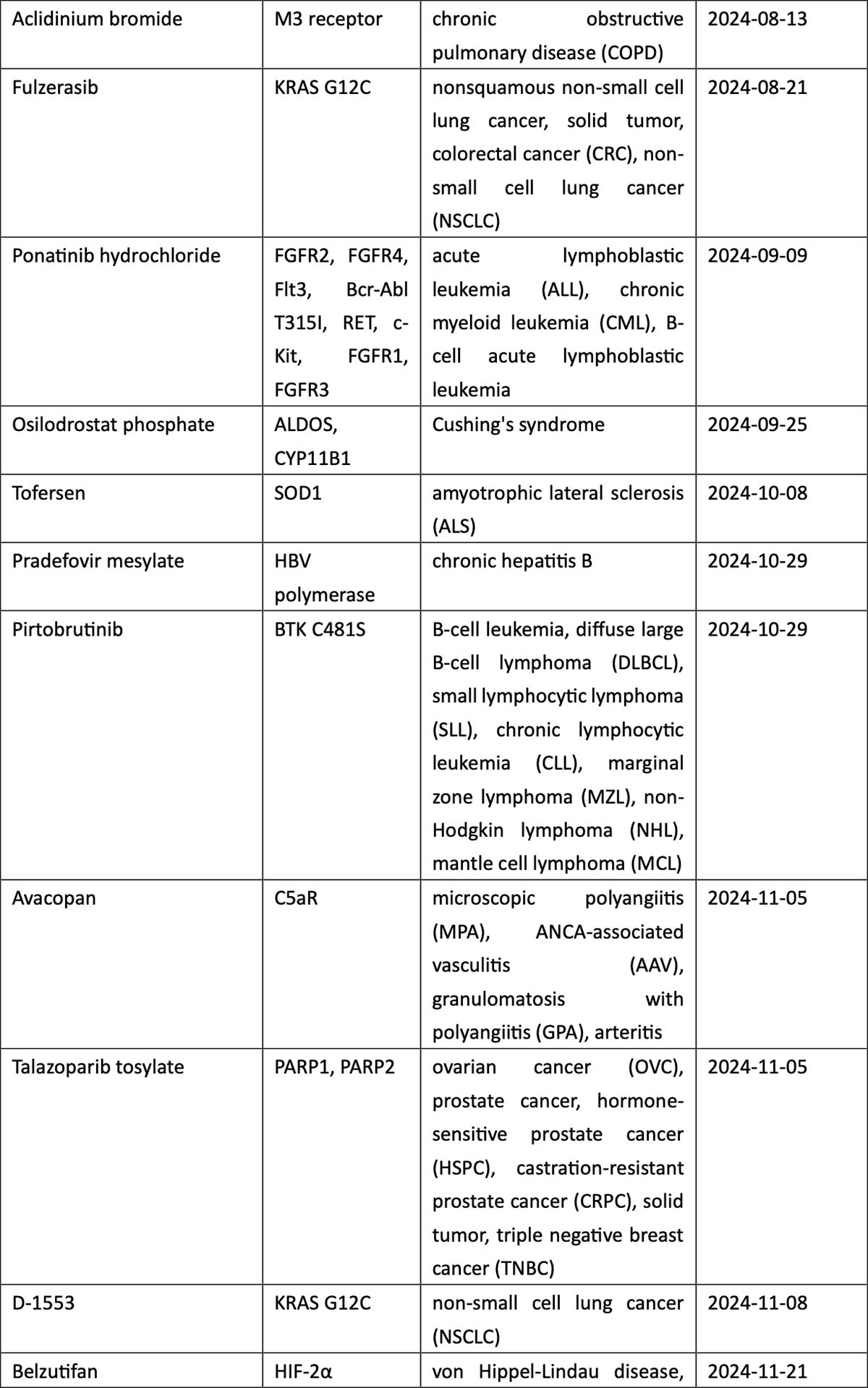

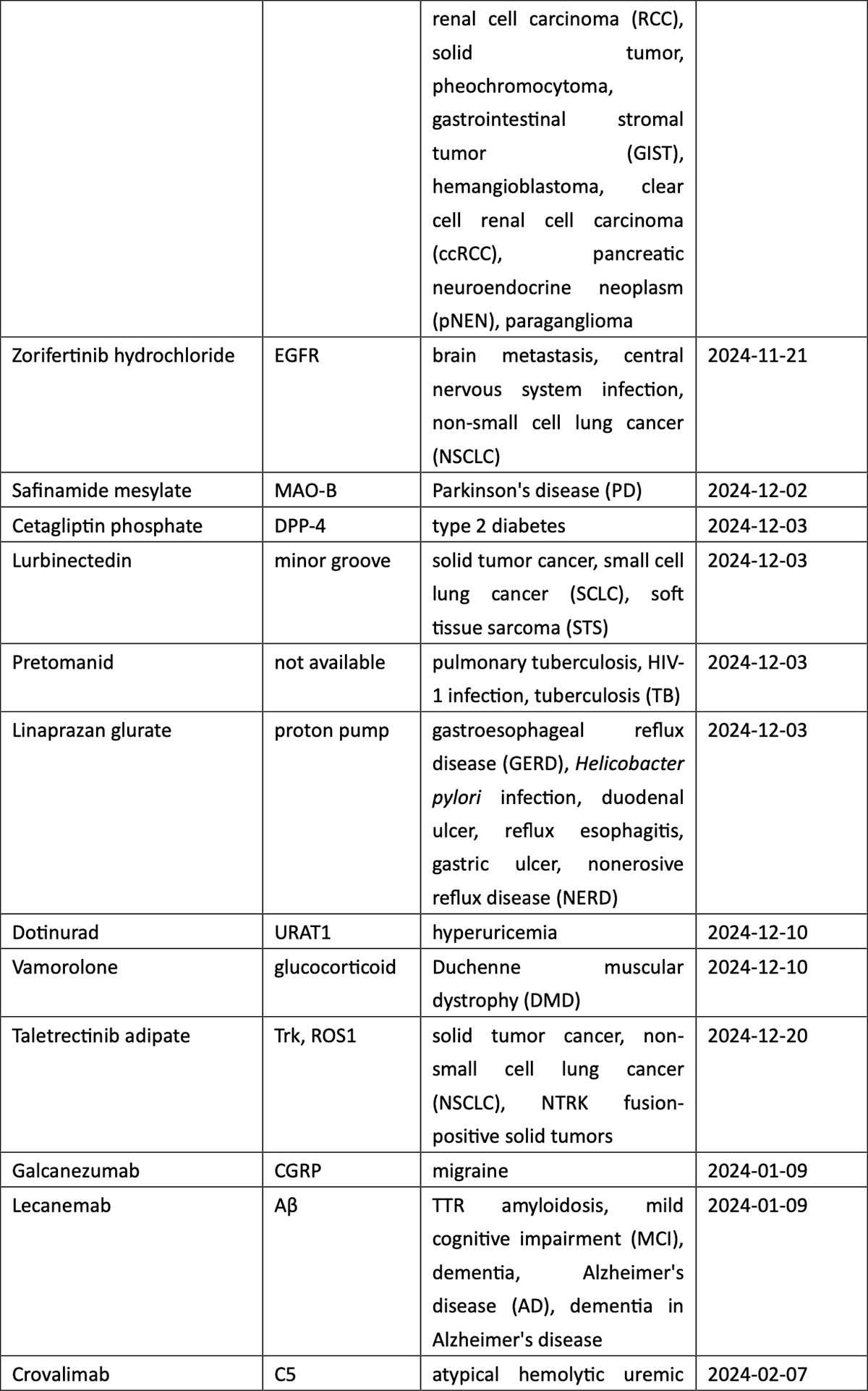

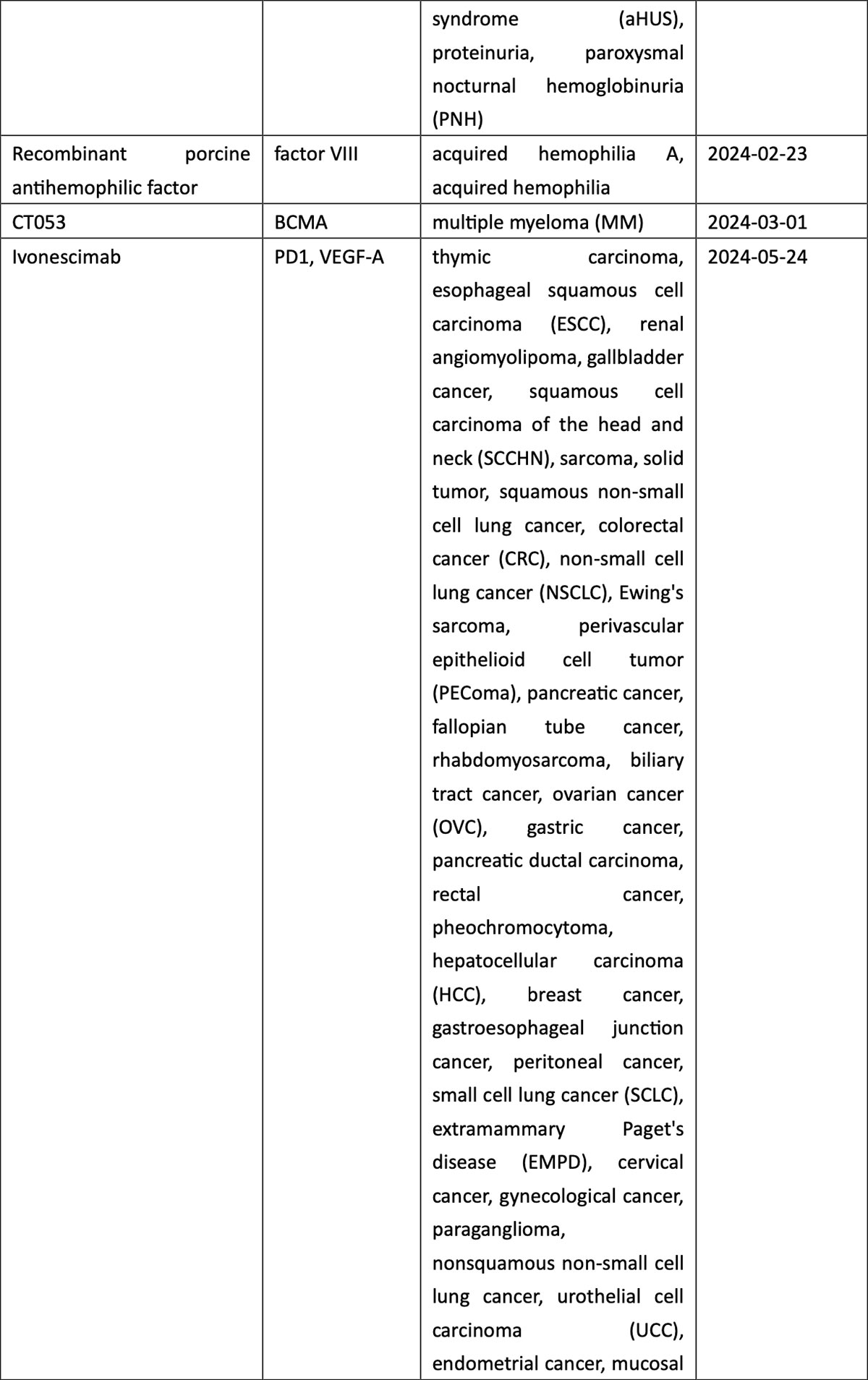

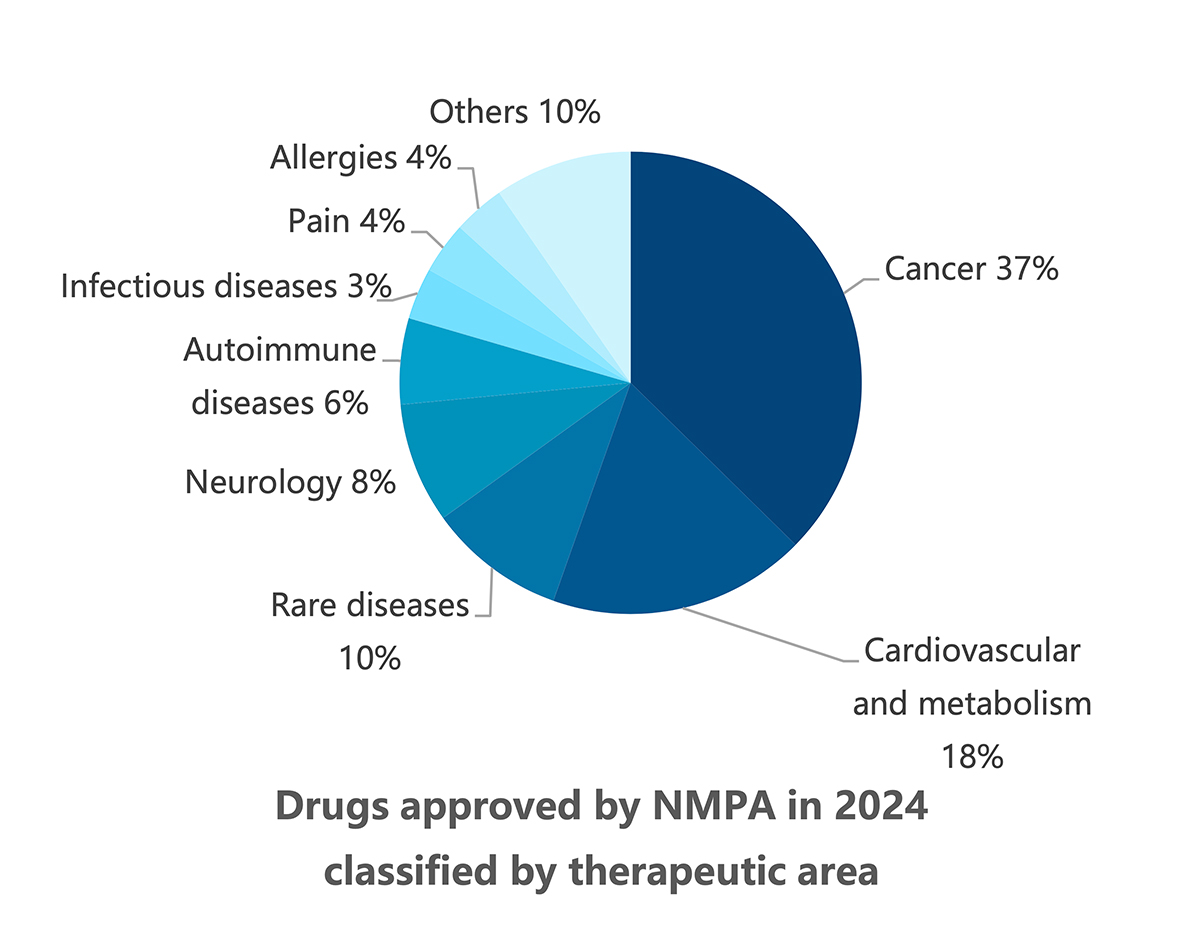

When classified by therapeutic area (TA), the 2024 new drug roster is listed by market potential. The high-prevalence segment of oncology accounts for 37% of total approvals, with non-small cell lung cancer (NSCLC) the most coveted indication in the country with the world’s largest population of tobacco smokers. New drugs for NSCLC include a local firm’s PD-1/VEGF dual antibody ivonescimab, as well as KRASG12C inhibitors fulzerasib and gesorexel, ROS1/NTRK inhibitors repotrectinib and taletrectinib, MET inhibitor capmatinib, ALK inhibitor envonalkib, and tyrosine kinase inhibitors (TKIs) targeting ROS1 (unecritinib) and EGFR (rezivertinib, SH-1028, and zorifertinib).

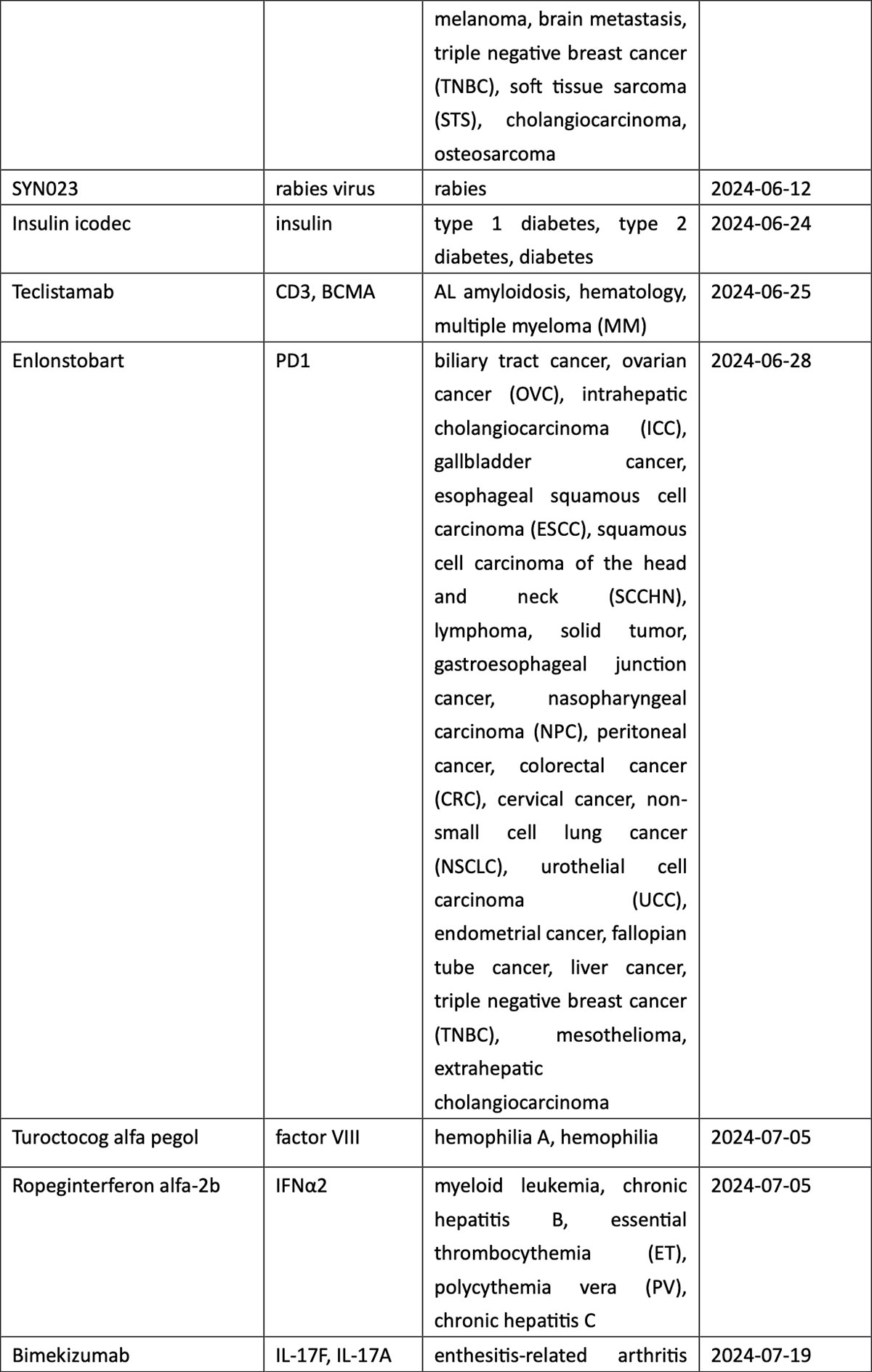

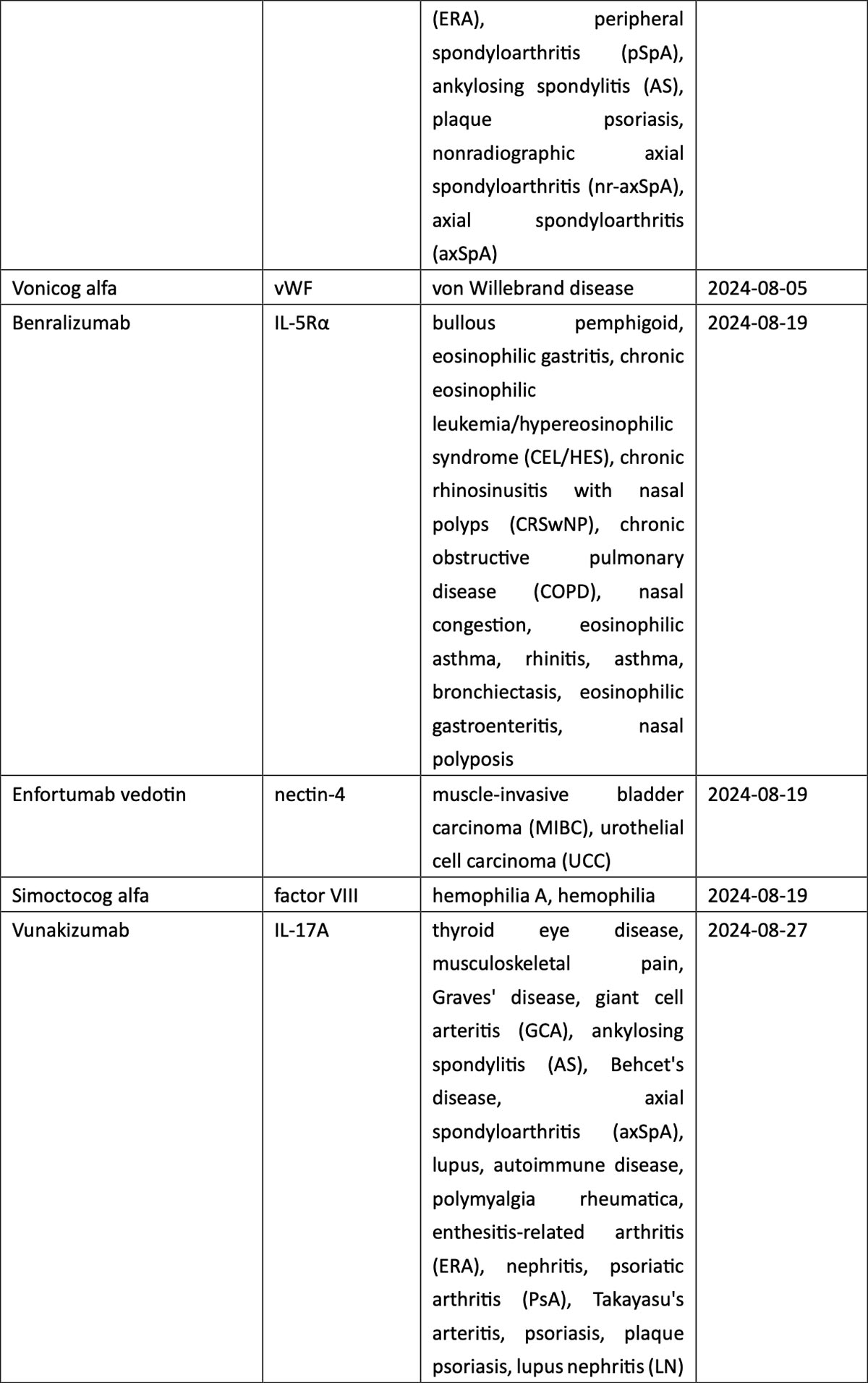

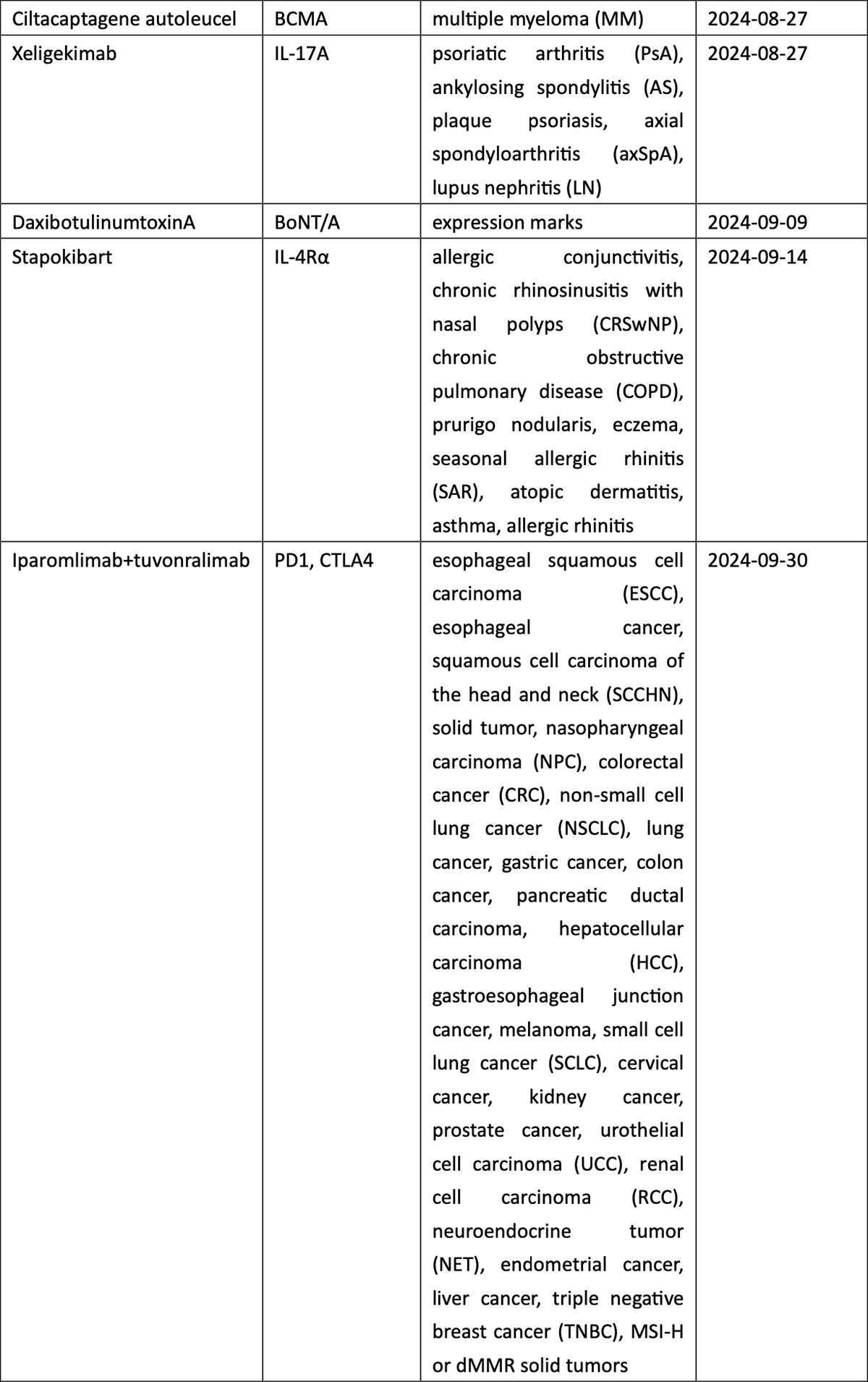

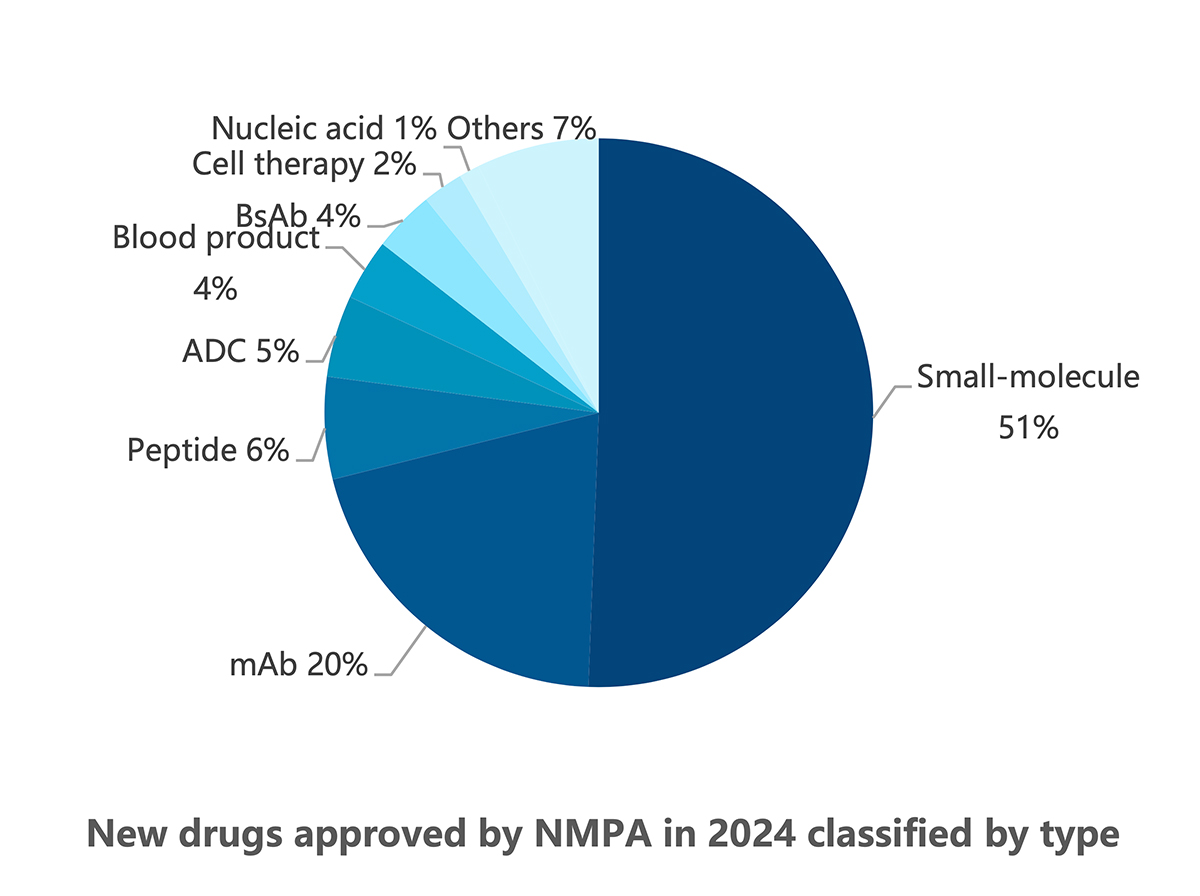

Breast cancer, urothelial carcinoma, and ovarian cancer also saw the arrival of innovative therapies, including ADC drugs targeting TROP2 (sacituzumab), nectin-4 (enfortumab), and FRα (mirvetuximab). The field of hematological tumors summoned ADC loncastuximab tesirine, CAR-T cell therapies CT053 and ciltacaptagene autoleucel, and BsAbs teclistamab and mosunetuzumab, among others (see graphic below).

Coming in second were cardiometabolic diseases with 18% of new drug approvals last year. The area was dominated by six new drugs for type 2 diabetes (T2D), namely GIPR/GLP-1R dual agonist tirzepatide, as well as insulin icodec, domestic DPP-4 inhibitors HSK7653, fotagliptin, and cetagliptin, and compatriot SGLT2 inhibitor ganagliflozin.

Next in line were rare diseases, accounting for 10% thanks to their profitability as high-cost treatments and little competition, with new entrants including iptacopan, avacopan, and rilonacept. These were followed by neurology with Alzheimer’s disease blockbusters donanemab and lecanemab. Surprisingly, the immunology area joined the rest of the TAs at the single-digit bench despite being commonly featured in pipelines worldwide, which might be explained by this area having one of the lowest drug development success rates from early and middle stage to approval.

Foreign Medicines Enjoy Unhindered Access to the Chinese Market

The critical importance of the healthcare industry for Chinese patients gives it a certain degree of immunity against ongoing trade tensions between China and some Western countries. In this context, foreign medicines received most of the new drug approvals from NMPA: A total of 50, including first-in-class therapies such as avacopan (for microscopic polyangiitis and other diseases), belzutifan (for von Hippel-Lindau disease and other diseases), benralizumab (bullous pemphigoid and other diseases), bimekizumab (enthesitis-related arthritis and other diseases), enfortumab vedotin (muscle-invasive bladder carcinoma and urothelial cell carcinoma), loncastuximab tesirine (diffuse large B-cell lymphoma and other lymphomas), mavacamten (hypertrophic cardiomyopathy), mirvetuximab soravtansine (ovarian and other cancers), mosunetuzumab (diffuse large B-cell lymphoma and other lymphomas), osilodrostat (Cushing’s syndrome), peficitinib (rheumatoid arthritis), pirtobrutinib (multiple leukemias and lymphomas), teclistamab (AL amyloidosis, hematology, and multiple myeloma), teduglutide (short bowel syndrome), tirzepatide (endocrine disorder and other diseases), and tofersen (amyotrophic lateral sclerosis). (See Appendix below.)

These external players are enjoying shorter review periods with the NMPA after a major reform in the previous decade, with four of their drugs getting the nod within a year of their first global authorization and one even getting approval in just over two months. However, they are also experiencing increasing competition from local companies after the dramatic development of China’s biopharmaceutical industry in recent years.

Reaping the Benefits of Boosting Local Industry

Domestic (Chinese) new drugs approved in 2024 totalled 34, a figure not too far from the above-mentioned 50 from multinational corporations. The gap proportionately narrows for small-molecule drugs: The 17 Chinese entrants came very close to the 25 imported; the positions even reversed for mAbs, with 9 locals outnumbering 8 imported.

The rising strength of Chinese new drugs results not only from their increasing numbers but also from their diversity across different drug types and disease areas, as well as from their degree of innovation. This is illustrated by the above-mentioned global-first PD-1/VEGF dual antibody, which came from a domestic company.

Another case in point is the long list of domestic drugs that became the third product in the world to obtain regulatory approval for their respective target molecules in 2024. These include tunlametinib, crisugabalin, SYN023, bevifibatide, vunakizumab, xeligekimab, and sacituzumab tirumotecan.

Despite the rising competition, the allure of getting a slice of the China market continues to draw MNC investments into the country in the form of R&D centers and production facilities. In 2024, the Beijing Economic-Technological Development Area (BETDA) was selected as the site of the future innovation or development centers of Eli Lilly, Pfizer, Bayer, and AstraZeneca, while the Chinese capital will host elsewhere a similar facility planned by MSD as well as Lilly’s first biotech incubator outside of its US homeland.

With China at the center stage of the global biopharmaceutical industry, competition in the country will only escalate with the continued emergence of novel products every year in a race that will not only galvanize the industry but also bring benefit to patients worldwide.

To learn more about drug approval in China, plan to attend our DIA China Annual Meeting 2025.