Around the Globe

Xu Wang

Novo Nordisk (China) Pharmaceuticals

Shanghai Center for Drug Evaluation & Inspection

n the tumultuous year of 2020, the COVID-19 pandemic did not appear to hinder the progress of regulatory reform and new drug approvals in China. The National Medical Products Administration (NMPA) continued to implement many regulations and guidelines. The number of drug applications and the timeline of review and approval were not negatively impacted.

Of the 46 new drugs, 31 were granted priority review. It should be noted that after implementing the newly revised “Drug Registration Regulation,” the number of NDAs with priority review designation decreased significantly from 2019, mainly due to the updated, more stringent criteria for priority review: (1) innovative or modified new drugs with urgent medical needs that are in shortage, or for the prevention and treatment of serious infectious diseases or rare diseases; (2) new products, dosage forms, and strengths of pediatric drugs; (3) vaccines and innovative vaccines urgently needed for disease prevention and control; (4) drugs with breakthrough therapy designation; (5) drugs qualified for conditional approval; and (6) other circumstances specified by NMPA. The Center for Drug Evaluation (CDE) is allocating more review resources to products with significant clinical advantages.

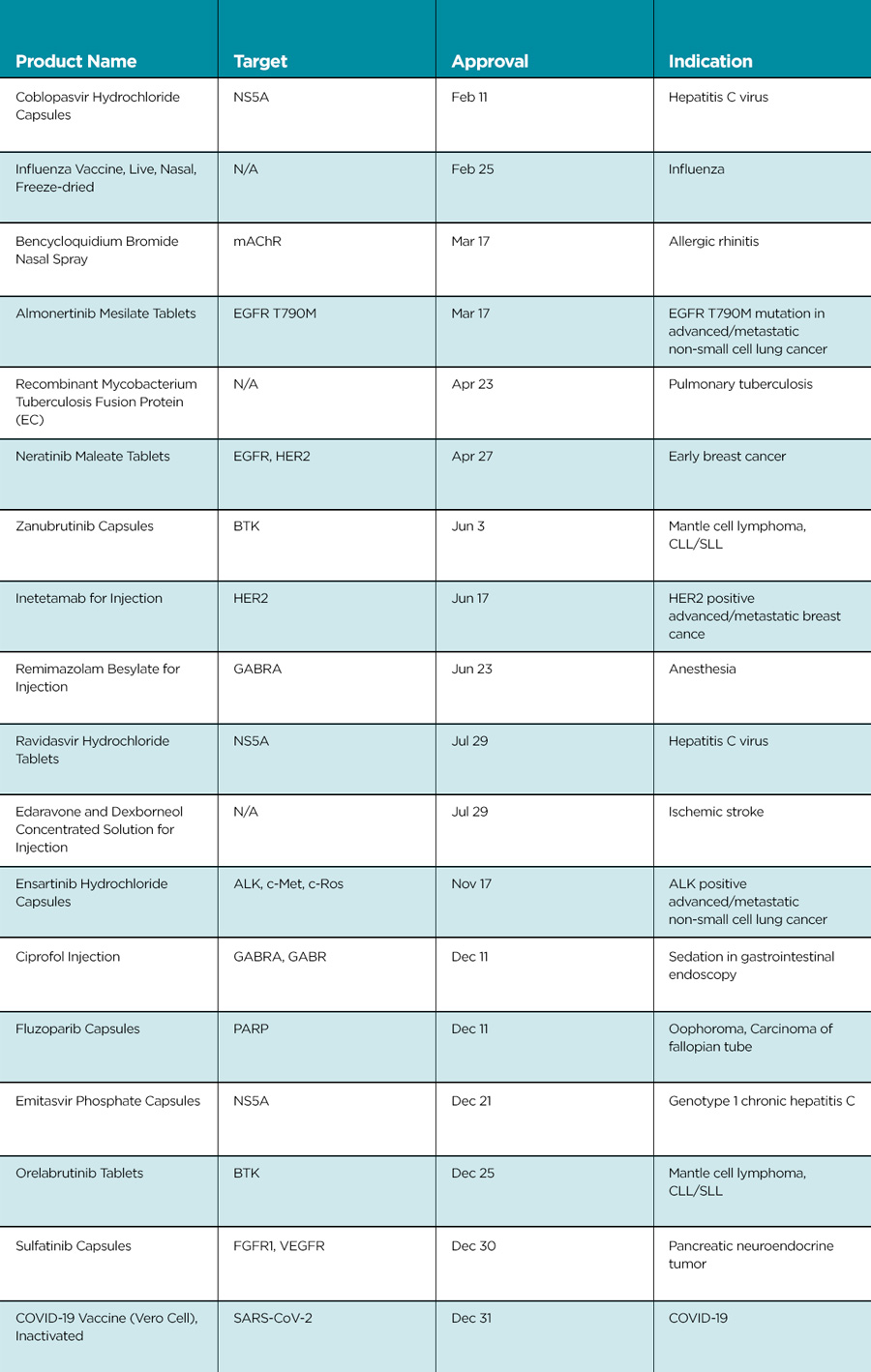

It was notable that seventeen locally developed new drugs were approved in 2020, setting a new record number of approvals of domestic new drugs (Table 2). The steady increase in domestic new drugs in recent years can largely be attributed to improvement in the drug development ecosystem, including policy reform, talent introduction, and capital investment.

By disease area, sixteen cancer drugs were approved and continue to account for the largest proportion of all new drugs approved.

Approved Cancer Drugs

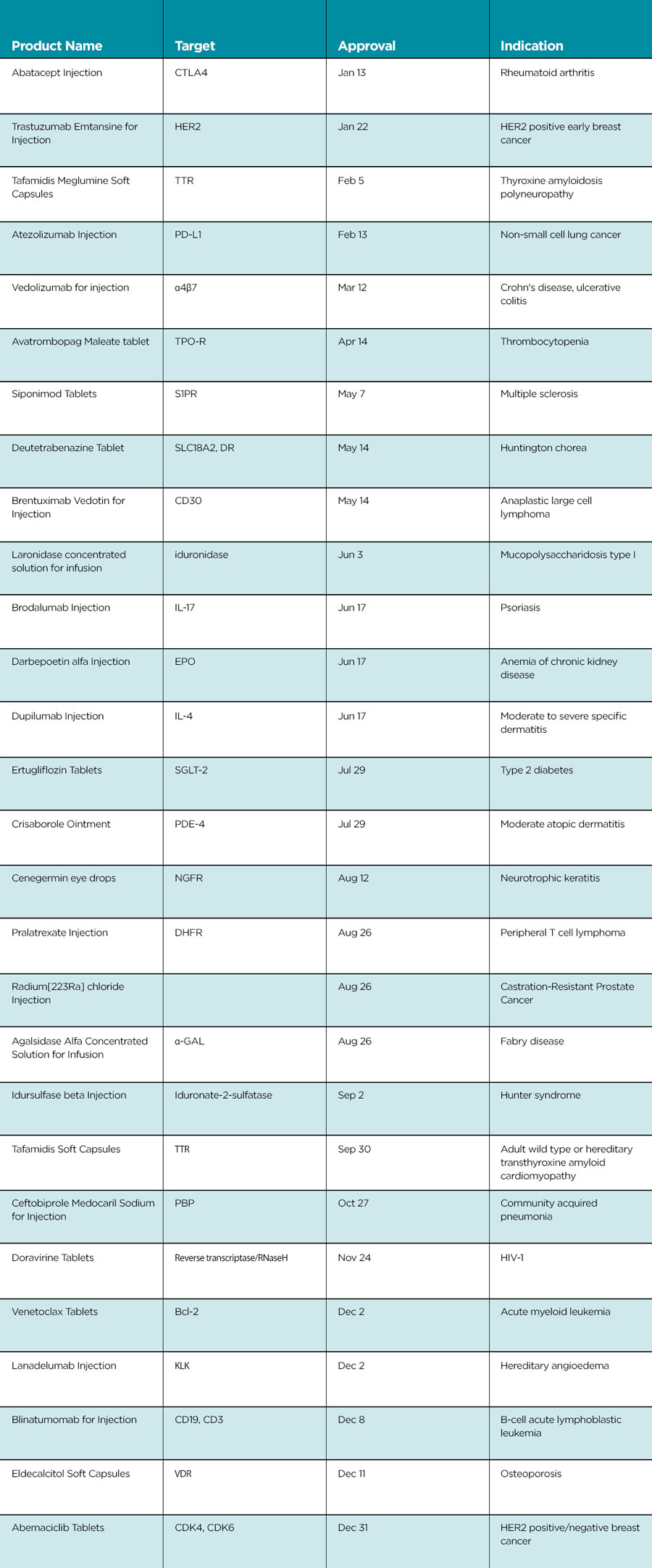

In early 2020, NMPA approved the first antibody-drug conjugate (ADC), trastuzumab emtansine. A few months later, the second ADC (brentuximab) was approved. This means that innovative therapies with ADC are now available to patients in need in China.

Blinatumomab is the second bispecific antibody approved in China, following emicizumab.

Approval of venetoclax, the world’s first and only marketed BCL-2 inhibitor, marks the availability of another new target cancer therapy in China.

Domestic Chinese innovative cancer drugs also have many highlights. Zanubrutinib may have attracted the most attention: Following its first global approval by FDA in 2019, the drug was approved in China in June 2020, making it the first domestic Bruton’s agammaglobulinemia tyrosine kinase (BTK) drug in China. The second domestic BTK drug in China, orelabrutinib, was approved by the NMPA at the end of 2020.

Other new domestic drug approvals include the first domestic PARP inhibitor (fluazolepali), VEGFR-TKI sulfatinib, anti-HER2 drug inetetamab, and ensartinib for the treatment of advanced non-small cell lung cancer with ALK mutation.

In the anti-infective field, NMPA approved three innovative NS5A inhibitors: coblopasvir hydrochloride, ravidasvir hydrochloride, and yilabuvir sodium. These approvals will further increase the availability of anti-HCV drugs in China.

However, it should be noted that new drug R&D in China has prominently followed a “me-too” and “me-better” strategy, and there have been few globally recognized first-in-class drugs developed by a domestic company to date. Current R&D of innovative drugs in China is mainly in “fast follow” mode. Although China has made great progress in basic research and clinical studies, there is much room for improvement in translational research. Whether there will be actual first-in-class drugs from China in the future remains to be seen.

Drugs for Rare and Other Diseases

The NMPA also encourages simultaneous global development of innovative medicines. Siponimod, approved in 2020, is an imported new drug in Category 1 (i.e., the drug has not been approved in any country at the time of NDA submission in China). This is the second drug approved in recent years in this category, following dacomitinib in 2019. With the regulatory and clinical trial environment continually improving, it is expected that more and more imported drugs can be developed simultaneously in China and overseas, and the drug lag in China can therefore be shortened.

2020 also ended in an extraordinary way. On the last day of year, the NMPA granted conditional approval to the first domestic COVID-19 vaccine (Vero Cell) Inactivated.