Around the Globe

Part 2: Education Reforms and Capability Enhancements

o meet the challenges of new requirements for R&D talent in the context of global pharmaceutical innovation trends, pharmaceutical R&D innovation leaders in China must exhibit strategic thinking, efficient cross-departmental communication and collaboration, and an agile working model in addition to their drug-development expertise.

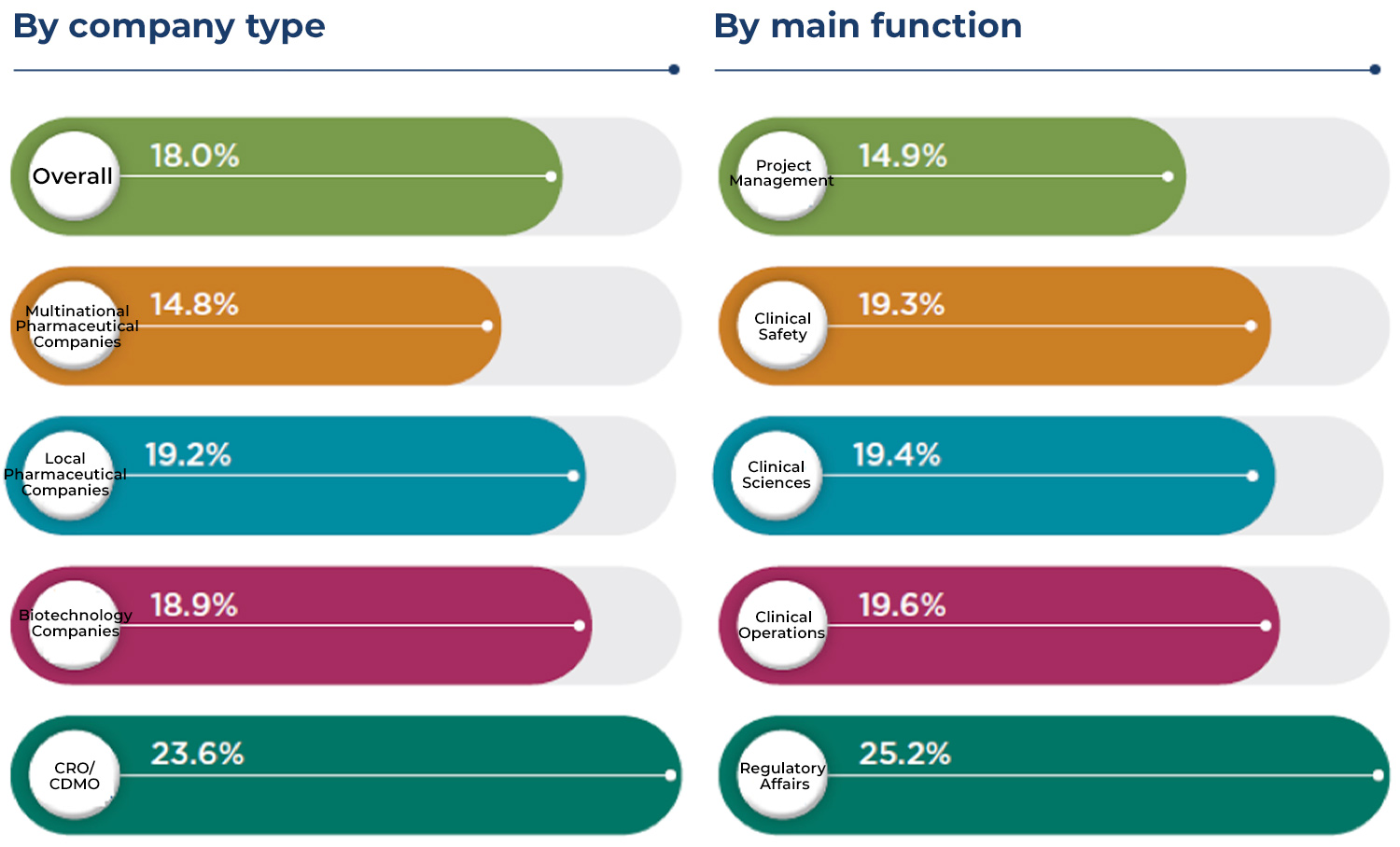

A 2021 study has shown that the overall growth in R&D staffing in the innovative pharmaceutical industry is anticipated to be as high as 42% in China compared to 2020, and biotech companies plan to grow their R&D staffing by 68%. The pharmaceutical industry boom continues to drive the demand for talent, but the supply of professional R&D talent cannot be increased overnight. This imbalance between supply and demand has caused a continuous battle for talent, with an overall turnover rate of 20.7% in pharmaceutical R&D in 2020, including an active turnover rate of 18.0% (Figure 1). Another noteworthy trend is R&D talent with multinational pharmaceutical backgrounds choosing to join local companies in new career endeavors: 30% of the R&D talent leaving multinational pharmaceutical companies in 2020 left to join local pharmaceutical and biotech companies, double the percentage in 2017 (15%). This high turnover rate has caused the compressed development of talent, a phenomenon unique to China at this stage in which employees are appointed to higher positions before they accumulate sufficient qualifications and experience: Currently, senior manager to director-level R&D talent in China generally has five to 10 years less seniority on average than their counterparts in the US and Japan. This high employee turnover rate is a challenge at the innovative pharmaceutical R&D industry level.

Source: Aon Pharma R&D Annual Survey(怡安医药研发年度调研)

In the face of the high talent turnover rate which will be difficult to resolve in the short term, talent recruitment and talent retention were the most important priorities for pharmaceutical company management teams and HR managers in China in 2021. A sustainable talent value proposition, an inclusive corporate culture, and an “entrepreneurial spirit” that inspires R&D personnel are the winning factors in the war for talent and the key to ensuring the sustainability of talent development at the industry level.

Sustainable talent value proposition: Whether multinational or local, pharmaceutical organizations in China can help R&D talent build a sense of purpose and promote individual growth and capability enhancement through long-term benefit guarantees and forward-looking incentive mechanisms, and by establishing clear values and career development plans for this talent in China.

Inclusive corporate culture environment: Within local pharmaceutical companies in China, innovation-focused R&D talent often comes from multiple backgrounds, including different multinational pharmaceutical company headquarters or R&D centers in China. Talents from diverse backgrounds bring valuable experience but may also retain certain standardized methods and ways of thinking. For example, R&D staff with multinational backgrounds often bring a company culture of collective decision-making style as well as reliance on more established internal process systems. On the other hand, employees with local professional backgrounds can be very familiar with China’s R&D environment but lack understanding and experience in international R&D decision criteria and processes associated with higher-risk innovative drugs. While recruiting new talent, companies must create more inclusive cultural environments to foster a sense of belonging for diverse R&D talent, encourage collaboration, and consequently build R&D models and internal mechanisms that will fit future corporate strategies.

Encouraging and stimulating the entrepreneurial spirit of R&D leaders: One of the main reasons R&D leaders and midlevel employees from multinational pharmaceutical companies join local companies in China is that they are looking for clearer, simpler internal decision-making processes, faster decision-making, and more leadership opportunities. In their battle for this talent, multinational pharmaceutical companies and large local pharmaceutical companies must continue to think about how to simplify entrenched complex organizational structures and internal processes and stimulate the entrepreneurial spirit of top- and midlevel management teams. This will in turn greatly promote the development and implementation of innovation within the sector.

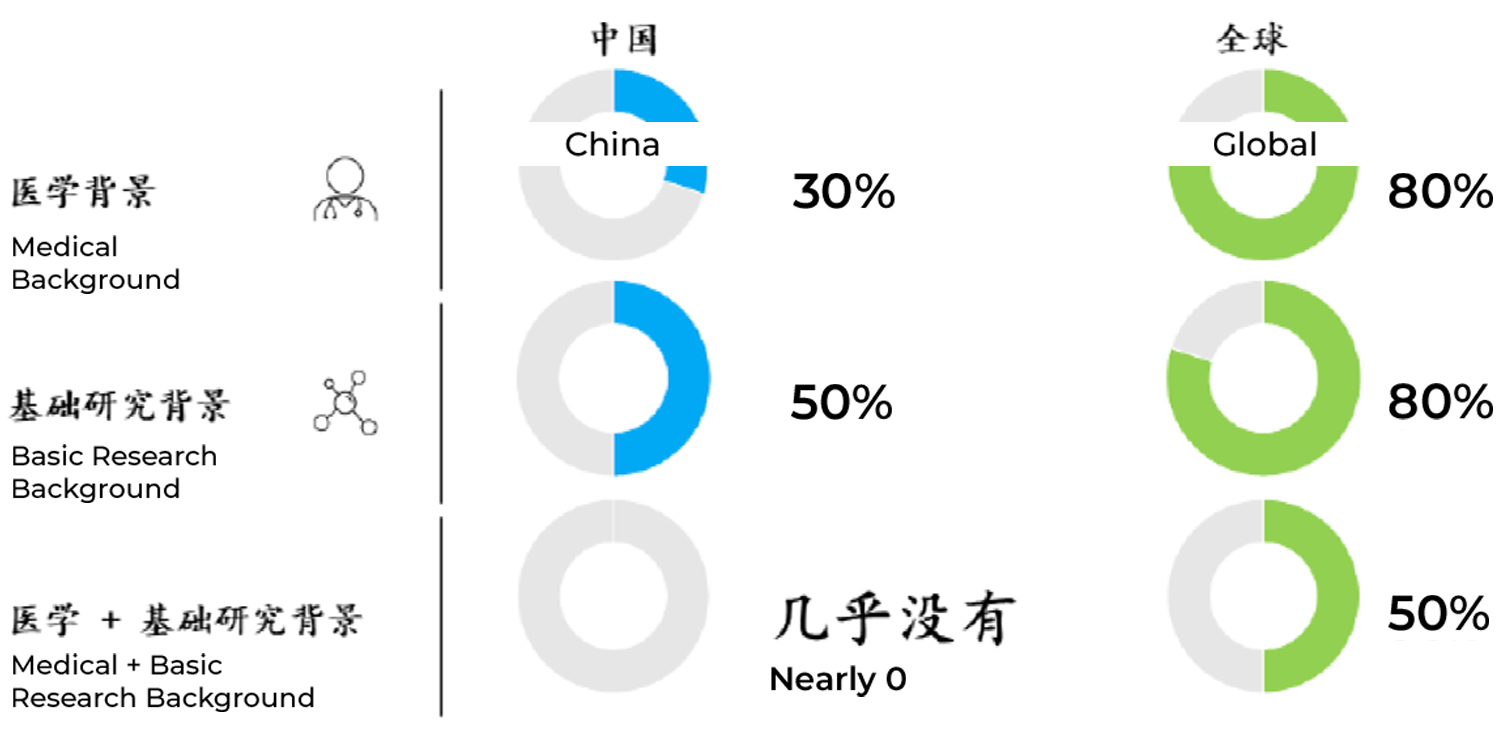

Chinese R&D leaders with a combined medical plus basic science background are scarce. Among the nearly 30 Chinese R&D leaders of multinational pharmaceutical companies, large local pharmaceutical companies, and local biotech companies we identified, approximately 50% have a basic science research background and 30% have a medical background, but few have a medical plus basic science educational background. Based on analysis of publicly available information (i.e., LinkedIn profiles, company website biographies), we estimate that approximately 80% of R&D leaders in the global headquarters of the top 10 multinational pharmaceutical companies have a strong background in basic scientific research (i.e., earned a PhD in biology or other related fields). Approximately 80% of these R&D leaders also have a medical background (i.e., earned an MD degree) and received systematic basic science training in the process of obtaining their medical degree, and 50% of them have both an MD and a PhD degree (Figure 2).

This relative lack of experience in early research (discovery, translational medicine, etc.) and the setup of the biomedical education system in China are interrelated. The MD-PhD program initiated in the US in the 1950s aims to train medical scientists to seamlessly integrate scientific research with medical practice. To date, more than 90 MD-PhD programs have been offered across the US, with a current enrollment of approximately 5,400 students. In 1964, the US National Institutes of Health launched the Medical Scientist Training Program, a special fund to support schools in the US offering the MD-PhD which has to date supported more than 10,000 people. The research work of MD-PhD graduates divides into about 60% related to translational research and 50% to basic research, and provides a sustained driver for pharmaceutical innovation in the US.

In contrast, the majority of MD-PhD programs at leading medical schools in China were launched quite recently. Based on literature related to domestic medical education research and a program search through the top 10 medical school websites, there is still much room for improvement, particularly in the number of programs, student scale (annual enrollment at each school is generally within single digits), and in academic arrangements and training pathways. Moreover, the domestic education and research evaluation system in China places more emphasis on the short-term publication of academic results (e.g., the number of Science Citation Index, or SCI, papers) and places less emphasis on aspects that are difficult to quantitatively measure (e.g., the clinical application of research results and development of students’ translational medicine knowledge). Compared to graduates with training in either basic science or clinical medicine, MD-PhD graduates in China are more likely to take on leadership roles in academic research centers, large pharmaceutical companies, and biotechnology companies. They are also more likely to undertake cutting-edge research and development tasks with a clinical problem-oriented approach, due to their solid basic research experience and systematic knowledge of clinical medicine. This source of training must improve to fill the remainder of this talent gap.

In terms of clinical development talent, China is similarly constrained by the existing medical education system. The focus of traditional medical education is mainly on disease diagnosis, treatment, and clinical application. Furthermore, clinical research-related courses are lacking, and most medical schools lack a variety of clinical research-related disciplines. Nevertheless, in the face of these challenges, we have in recent years seen promising attempts by leading institutions in China, such as the establishment of China’s first clinical research methodology discipline at Peking University in 2013, and establishment of the Department of Clinical Epidemiology and Clinical Trials at Capital Medical University in 2020.

Industry demand for talent with a combined background of medicine plus basic science and for trained clinical research professionals will require the medical education system in China to adapt to these times and trends. In the face of structural changes in the talent demand for pharmaceutical innovation in China, targeted education system reform should focus on training clinical research scientists and building specialized clinical research teams, which will in turn help promote clinical research and expedite pharmaceutical innovation in China.

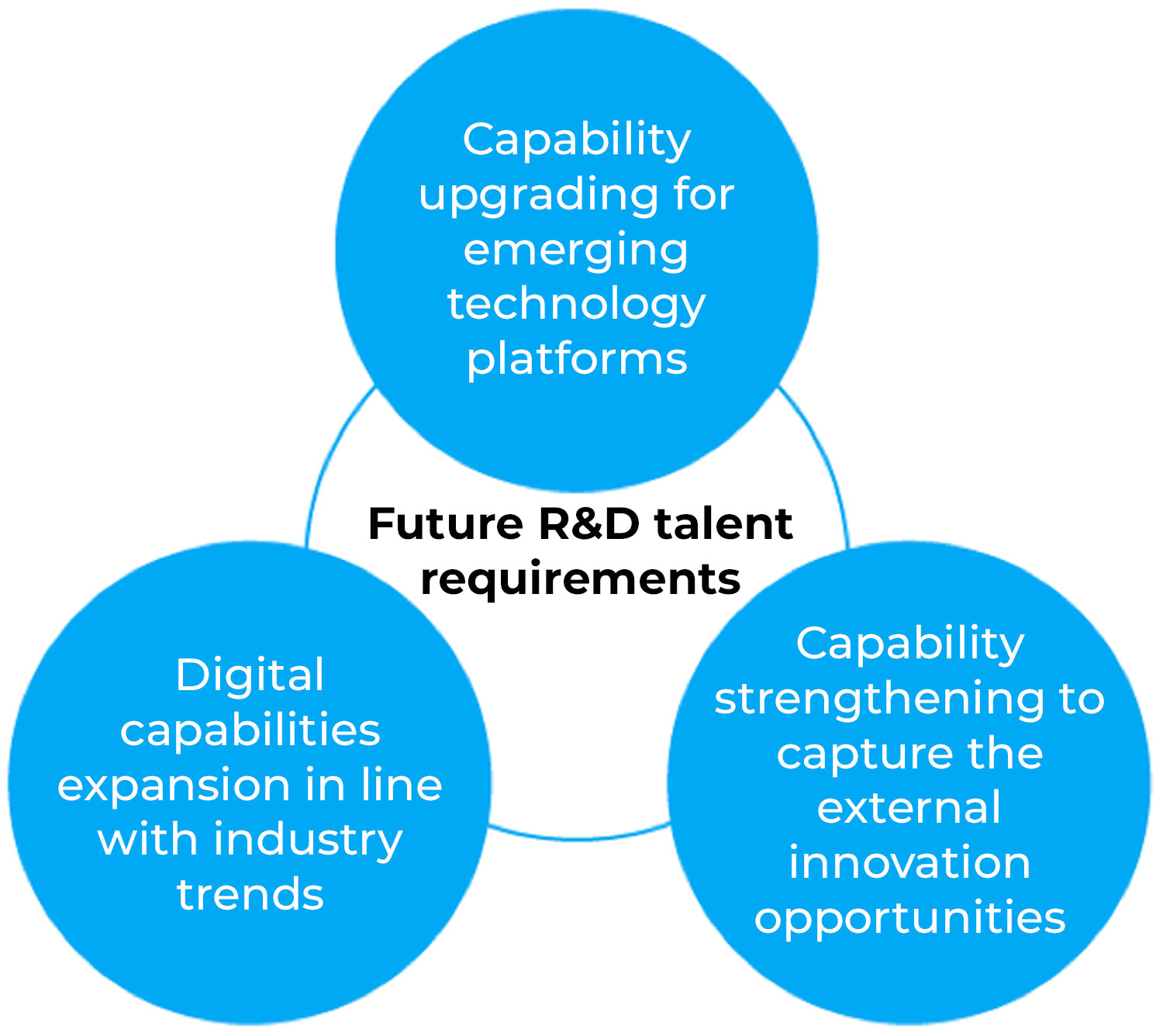

China is closing the gap between local innovation and global “firsts.” The next five to 10 years will see a shift from “fast following” to “leading,” and these breakthrough innovation strategies will place higher demands on the business capabilities of R&D talent. At the same time, in the context of continued global innovation in pharmaceutical R&D, China’s new R&D talent must continue to adapt to key global R&D trends, including the emergence of new technology platforms, the application of big data and artificial intelligence, and extensive external collaborations (Figure 3).

Figure 3: Key global trends facing future R&D talent in China.

Capability upgrading for emerging technology platforms: Pharmaceutical innovation is driven by an in-depth understanding of disease biology on the one hand, and by advances in treatment technology on the other. From traditional small molecules to monoclonal antibodies that started to emerge two decades ago, up to the recent boom of multi-specific antibodies, antibody-drug conjugates, and cell and gene therapies, the emergence of breakthrough technologies has played a decisive role in driving industry progress. The ability to keep up with development of emerging technology platforms to upgrade their own capabilities has become key to the success of future-oriented R&D talent in China.

Digital capabilities expansion in line with industry trends: Big data and artificial intelligence technology have been continuously applied in the corporate world, such as in the manufacturing and financial sectors. In healthcare, big data and artificial intelligence are also beginning to rise in prominence and will play an increasingly important role in future R&D. From drug target discovery derived from basic research and drug screening based on structure prediction, to innovative design of clinical trials and optimization of clinical trial site selection, big data and artificial intelligence have the potential to overcome the high cost and low efficiency downsides of traditional research methods. Developing R&D staff with specialized digital capabilities is particularly important to better understand and implement relevant tools, work closely and efficiently with data teams, and ultimately improve R&D output.

Capability strengthening to capture the external innovation opportunities: External collaboration has become an important tool for global pharmaceutical innovation to help enrich the R&D pipeline, complement internal R&D capabilities, optimize resource allocation, and improve R&D efficiency. Our analyses indicate that a significant portion of global innovative drug revenues, including many of the world’s top 20 blockbuster drugs, now come from external collaboration assets. The emergence of modern technology platforms has further prompted leading pharmaceutical companies to leverage external innovation. The timely grasp of external innovation opportunities in the dynamically changing market environment requires R&D staff to keep a close eye on the external market, fully understand the demands of partners, and embrace diverse cooperation models with an inclusive mindset.

Looking Ahead