igital technologies, defined as the electronic tools and devices that can produce, analyze and store data, have the potential to transform clinical trials by supporting virtual interactions between patients and researchers and clinicians. In April 2020, it looked like more than half of investigative sites were shifting to virtual methods of patient interaction. However, results from DT Consulting’s inaugural clinical trial survey indicate that many clinical trial sites are still reluctant to integrate digital technologies into their process and that cost, complexity, and finding the right technologies are the main barriers to digital adoption. This, despite the extraordinary disruption and halting of trials after the outbreak of COVID-19.

The survey was sent to all global interventional studies that launched from October 2019 through September 2020 — the six months before and after the COVID-19 outbreak. About 261 clinical trial sites, many coordinating studies executed across different countries/regions, responded to the survey—which represent about 6 percent of actively recruiting trials globally—and results show that they:

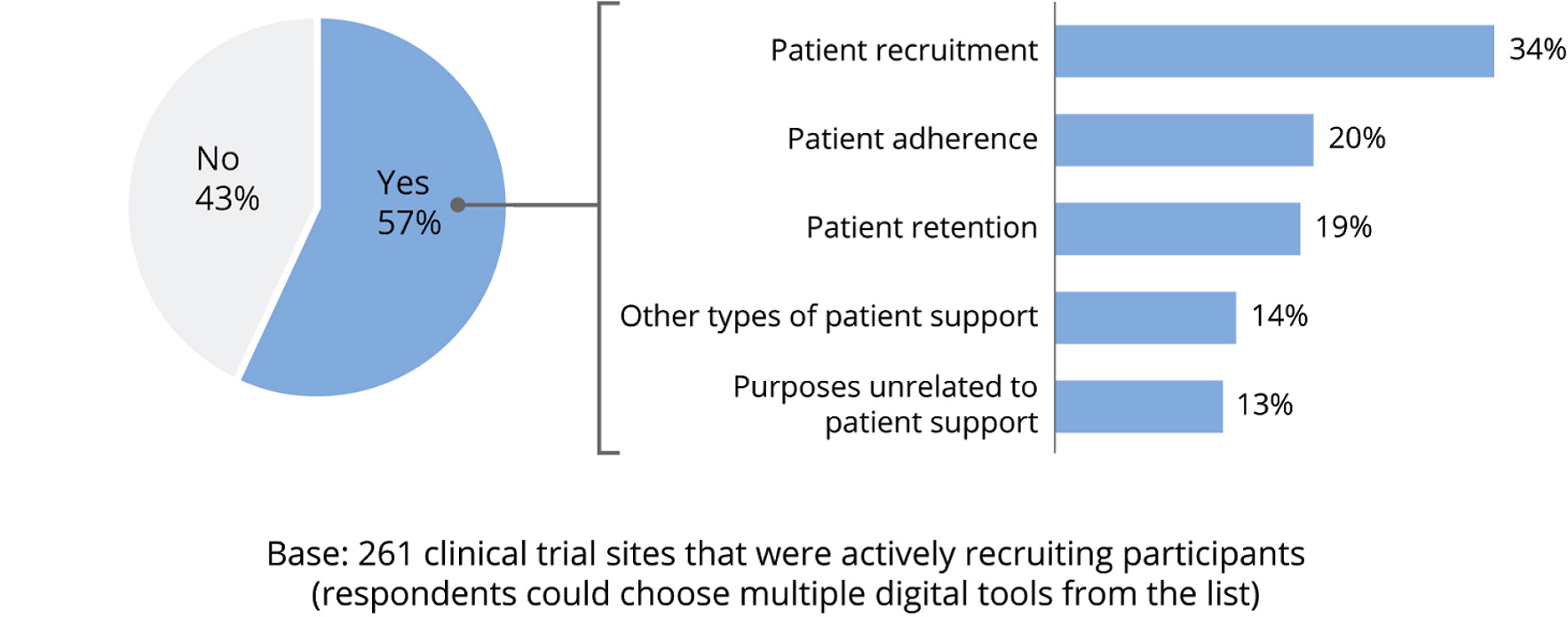

- Often use no digital tools at all. Among the respondents, 43 percent do not use digital tools to support clinical trials. Of the respondents that use digital tools, most use digital tools for patient recruitment.

- Use RWD/RWE tools for patient retention and virtual trial platforms least often. Only 4 percent reported using real-world data or real-world evidence. Virtual trial platforms, relationship management portals, and patient experience platforms also had low adoption (5 percent to 6 percent).

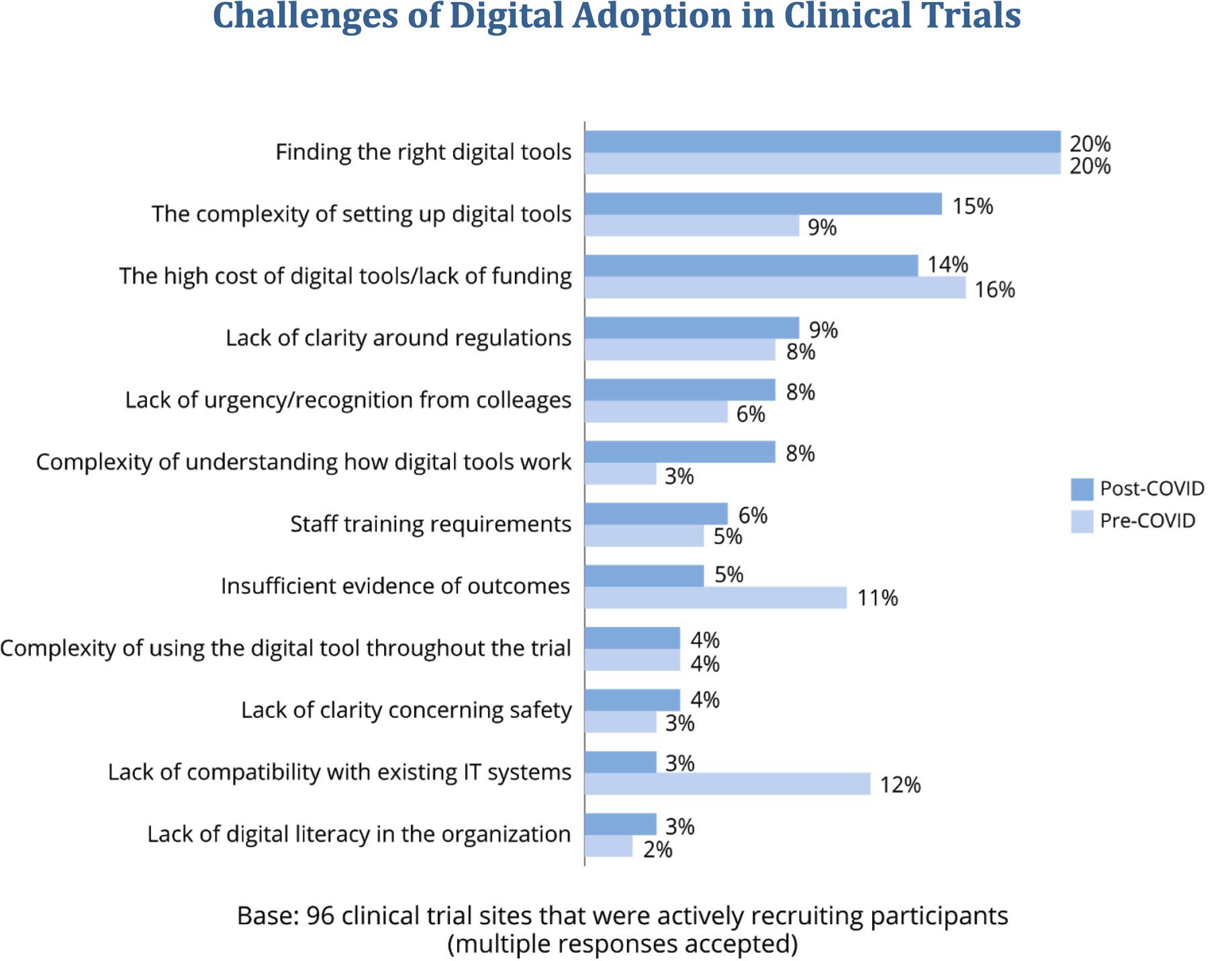

- Find that cost, complexity, and finding the right technology most challenge digital adoption. Several digital adoption challenges rose in significance after the COVID-19 outbreak: After March 2020, there was a sharp increase in the percentage of respondents citing the complexity of technology setup (from 9 percent to 15 percent) and the complexity of understanding how digital tools really work (from 3 percent to 8 percent) as challenges. Outcome evidence and compatibility with existing IT systems were much less often seen as barriers post-COVID.

- Adopt digital recruitment channels, virtual visits, and eConsent most often. When sites were asked which digital tools they were using or planning to use to conduct their trial, 22 percent mentioned recruitment channels; 14 percent use eConsent and digital documents; and 13 percent use virtual consultation channels such as video, phone calls and messages. The primary digital recruitment channels that respondents use are social media, websites and email.

- Consider adherence support tools the most effective at improving clinical trial processes. Three-quarters of respondents using patient adherence tools said that they are very or extremely likely to enable successful trial completion. A few other technologies did very well: Respondents using these technologies said that virtual consultation channels (62 percent), recruitment channels (56 percent), and remote monitoring (53 percent) are extremely likely to have a positive impact on trials.

The DT Clinical Trial Digital Tracker survey will be revisited in another six months to assess the levels of digital technology adoption, to ascertain if new digital tools deliver the best results in different trial site settings, and if there are new challenges faced by sponsors and investigators embracing a digital mindset into their traditional operating model.

The DT Clinical Trial Digital Tracker Survey. 2020 was an email-initiated online survey based on the data base at www.clinicaltrials.gov.

The survey covers all industry-funded interventional studies that launched between October 1, 2019 and September 30, 2020 andwere actively recruiting participants – a total of 4, 641 studies globally.

DT Consulting contacted principal investigators via email in December 2020 and invited them to participate in the survey. 261 clinical trial sites responded to the survey and 124 of them filled out the entire questionnaire.