n a departure from their approach to previous PMDA Town Halls held at DIA Global Annual Meetings, at DIA 2024 this past June, leaders from the Pharmaceuticals and Medical Devices Agency (PMDA) of Japan invited sponsors and researchers to discover the benefits of developing innovative therapeutic products in Japan, based on Japanese market information and pharmaceutical regulation.

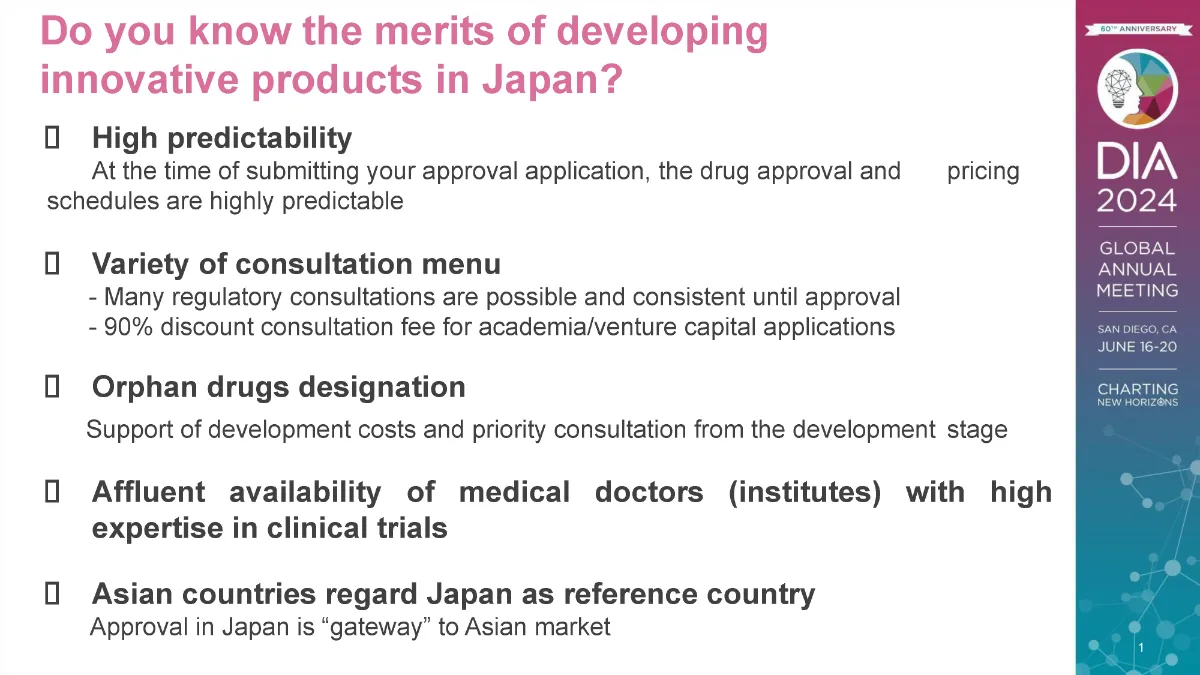

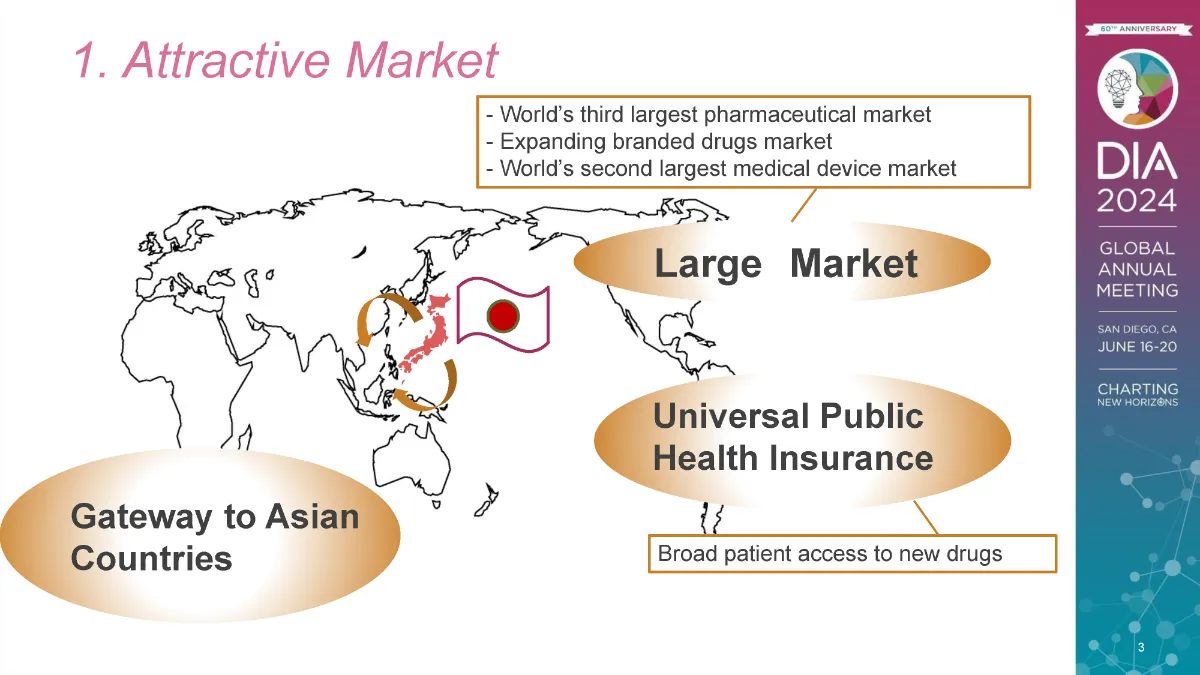

Size of Market

Japan is the world’s third largest drug market, behind only the United States and China. It is the world’s second largest market for medical devices, behind only the United States. It is also the world’s second largest market for branded drugs, behind the United States, and this branded drug market is expanding at the same rate as the US and Europe.

In addition, Japan abounds in expert medical investigators and institutions who can conduct clinical trials with excellent quality and few protocol deviations. PMDA has long conducted GCP inspections of clinical trials in Japan and publishes the results in a report (Japanese only). For example, of 192 sites inspected, only 17 (8.8%) were found to need improvement in GCP compliance of clinical trials of new drugs or regenerative medicines.

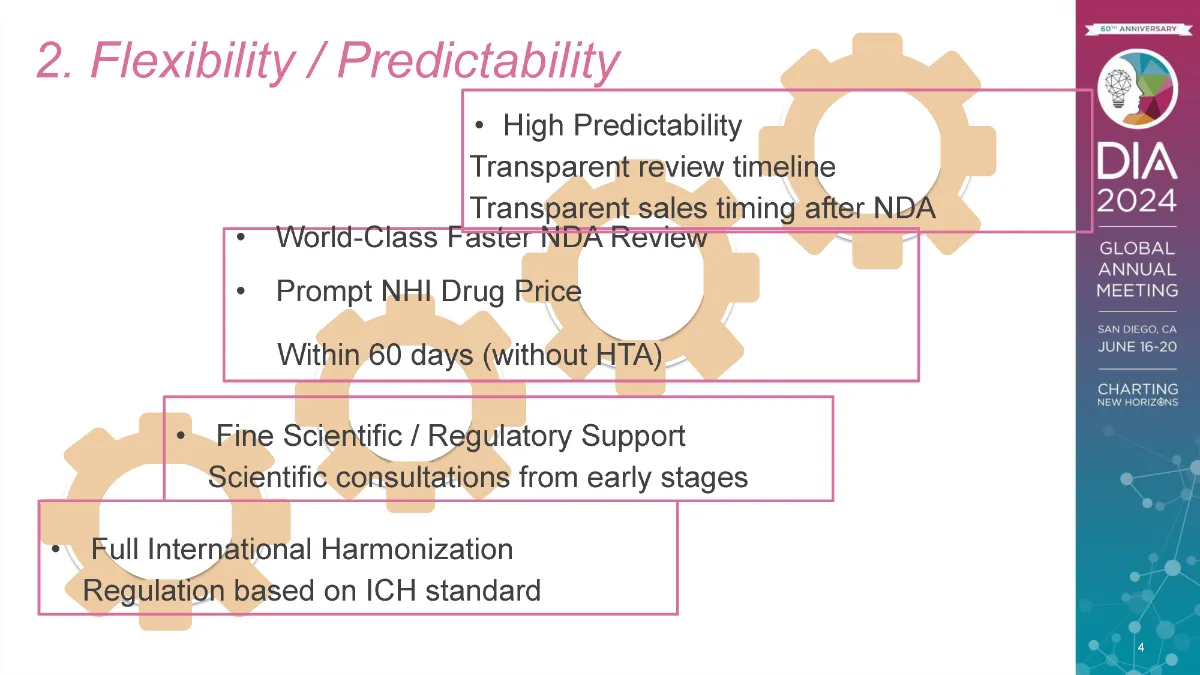

Regulatory Predictability and Flexibility

The regulatory authorities in Japan, together with the US and Europe, are the founding members of the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH). Japan’s drug regulation is harmonized to ICH standards. The idea that Japanese pharmaceutical regulations are completely different and more difficult than those in the US and Europe is now a dated misconception.

In Japan, the time needed for regulatory review is now highly predictable. For almost every product category, the target review time (also called the “time clock”) is established and published on the PMDA website (see page 26 of this document). PMDA rarely misses this target. As a result, sponsors and developers can easily predict at the time of submission of a marketing approval application to PMDA when that product will be approved. Such predictability is important in research and development plans.

PMDA offers substantial support for the development of medical products in Japan, especially through its variety of scientific advice and consultations from early development through post-marketing phases. The positions stated by PMDA reviewers in these consultations remain consistent with PMDA’s decisions throughout the development program and regulatory review. The customer satisfaction rate with this consultation service is more than 90% (see pages 55 and 76 of this report). In addition, academic institutions and start-ups that meet certain criteria receive substantial discounts (90%) off their fees for these consultations (see consultation services outline [Japanese only]).

Advantages Based on Product Characteristics

Products designated as an orphan drug or orphan medical device receive financial development aid, in the form of government subsidies and tax breaks, and prioritized consultation and review of their development programs, which reduces the time and expense needed to bring these products to the market.

In 2014, to promote innovative R&D in Japan, Japan’s Ministry of Health, Labour and Welfare (MHLW) launched the Sakigake program, Japan’s counterpart to the US FDA’s Breakthrough Therapy designation (designed to expedite development and review of drugs intended to treat a serious condition) or EU Priority Medicines (PRIME) scheme (which targets conditions of unmet medical need). Sakigake aims at early marketing applications for innovative pharmaceutical products, medical devices, and regenerative medicines, and products that win this designation are assigned a PMDA review manager specifically for that product to facilitate its development and review. Marketing applications must be filed in Japan prior to or at the same time as applications in the rest of the world (countries that have approval systems at a level equivalent to that of Japan), with an emphasis on early development in Japan (the date of application in the first country shall be the starting date, and applications filed in Japan within 3 months of that date shall be considered simultaneous applications). PMDA prioritizes completing regulatory review of Sakigake products within six months of the application submission.

Orphan and Sakigake products also receive pricing premiums (i.e., several percent will be added to the calculated NHI price) on their National Health Insurance listed price.

Speed to Market

In Japan, no drug can be meaningfully used unless it is covered by health insurance.

Japan maintains a universal health coverage insurance system, which enables all nationals to afford the latest drugs. Products approved in Japan and listed on the NHI price list can be used all over the country, and sponsors can expect an attractive number of prescriptions.

The process from JNDA application through approval to price setting is time managed tightly. New drugs can be qualified for reimbursement in Japan in approximately 60 days, and no later than 90 days, after marketing authorization is granted by MHLW following PMDA review by putting the drugs’ names and prices on the NHI price reimbursement list for the country’s universal health insurance system. This speed and timeline predictability are partly attributable to the fact that the authority does not perform health technology assessment (HTA) at the time of this listing.

Further Considerations

Japan is currently reviewing and working to improve its pharmaceutical regulations. These activities include PMDA’s promotion of multiregional clinical trials (MRCTs). The agency has been formulating a guidance document to clarify when a phase 1 study within the Japanese population would not be required before conducting a MRCT if it will include this population in its later phases. Efforts to designate orphan products earlier in the development and regulatory cycles are also being made.

The Asia Office in Bangkok, Thailand (which is conveniently located regionally and is home to many international organizations) will cooperate with regulatory authorities from Asian countries to ensure that medical products approved in Japan are made accessible to patients in ASEAN and other Asian countries more quickly.